10 value stocks expected to act like growth stocks through 2024

[ad_1]

Last year, when the broad decline for the stock market was led by technology companies, value stocks held up relatively well. So far in 2023, tech has been on a tear, but with interest rates still rising and other factors — including a banking crisis and now an oil-supply jolt — keeping investors jittery, this may still be a good time to think about value stocks.

Below is a screen of the Russell 1000 Value Index

RLV,

narrowing the group of companies to 10 that analysts expect to put up big growth numbers over the next two years. Some of these may run counter to what you expect to see in a “value” index, but the list can be useful for your own investment research.

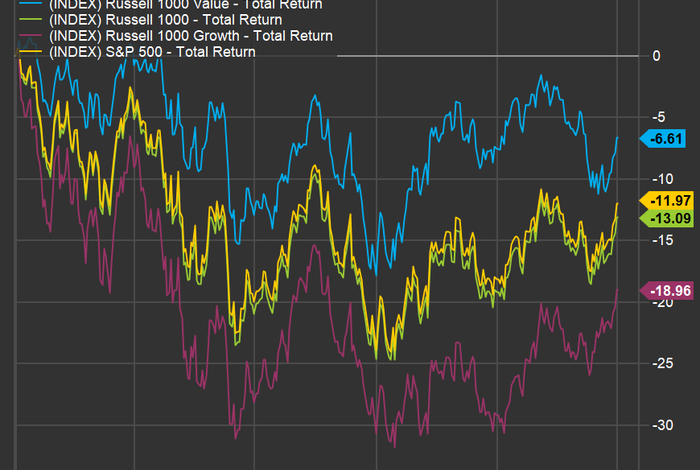

First, take a look at this chart for several broad indexes from the end of 2021:

The Russell 1000 index has held up best among these four broad indexes since the end of 2021.

FactSet

The Russell 1000 index

RUI,

is designed to capture the performance of the largest 1,000 U.S. stocks, representing about 93% of the domestic equity market. The Russell 1000 Value Index is a subset of the Russell 1000, made up of 851 companies “with relatively lower price-to-book ratios,” lower forecasts for growth and “lower sales per share historical growth (5 years),” according to FTSE Russell.

Descriptions and factsheets for the Russell indexes are available here.

One interesting aspect of such a large group in the value camp is that some of the companies are expected to put up solid growth numbers over the next two years.

Last week we screened the S&P 500

SPX,

to narrow that group of stocks to an “exclusive growth club” of 11 companies.

Applying the same screen of expected growth rates for sales, earnings and free cash flow to the Russell 1000 Value Index yields a new list of 10 companies. Here’s how we ran the screen:

-

There are 851 stocks held by the iShares Russell 1000 Value ETF

IWD,

+0.74% . - 817 of the companies are covered by at least five analysts polled by FactSet.

- We removed any company for which consensus estimates for earnings per share or free cash flow were unavailable or negative for 2022, 2023 or 2024. We used calendar-year estimates for a uniform set of data, because many companies have fiscal years that don’t match the annual calendar or even calendar month-ends. This narrowed the list to 388 companies.

- Then we narrowed further to the 10 companies for which the estimates predict compound annual growth rates (CAGR) of at least 15% (rounded) for sales, 10% for earnings per share (EPS) and 10% for free cash flow per share (FCF) from 2022 through 2024.

Here they are, sorted by expected sales CAGR from 2022 through 2024:

| Company | Ticker | Two-year estimated sales CAGR through 2024 | Two-year estimated EPS CAGR through 2024 | Two-year estimated sales FCF through 2024 |

| Snowflake Inc. Class A |

SNOW, |

39.6% | 93.6% | 50.0% |

| Bill Holdings Inc. |

BILL, |

31.0% | 97.6% | 147.0% |

| Albemarle Corporation |

ALB, |

28.4% | 14.1% | 46.4% |

| Take-Two Interactive Software Inc. |

TTWO, |

25.0% | 37.8% | 116.8% |

| DoubleVerify Holdings Inc. |

DV, |

23.2% | 20.2% | 39.7% |

| Jamf Holding Corp |

JAMF, |

18.1% | 52.3% | 23.7% |

| Ceridian HCM Holding Inc. |

CDAY, |

17.8% | 42.3% | 134.5% |

| EQT Corporation |

EQT, |

16.8% | 30.8% | 35.8% |

| Definitive Healthcare Corp. Class A |

DH, |

16.0% | 14.4% | 61.6% |

| Block Inc. Class A |

SQ, |

14.6% | 55.1% | 1865.6% |

| Source: FactSet | ||||

Click on the tickers for more about each bank, including news coverage, financials and analysts’ opinions.

Read Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

It might surprise you to see some “growthier” names on this list, including TakeTwo Interactive Software Inc.

TTWO,

and Block Inc.

SQ,

For Take Two, video game life cycles or COVD-19 may have played a role, as the company experienced sales growth of only 4% in 2021. Sales rose 42% in 2022. Nobody knows when the company’s subsidiary RockStar Games will release Grand Theft Auto 6, but that development is expected by analysts to cause a spike in sales at some point. GTA 5 was released in 2013.

Block is up 9% this year, despite taking a tumble last month after Hindenburg Research, a short seller, accused the mobile payments processor of “reporting inflated user metrics.” As you can see below, most analysts working for brokerage firms are still confident in Block.

Here’s a summary of analysts’ opinions about these stocks. They are listed in the same order as above, and forward price-to-earnings ratios are included. Many of these are high, relative to the forward P/E of 14.1 for the iShares Russell 1000 Value ETF and 18.2 for the S&P 500. But there are many factors that go into FTSE Russell’s placement of stocks in the Russell 1000 Value Index.

| Company | Ticker | Forward P/E | Share “buy” ratings | March 31 closing price | Consensus price target | Implied 12-month upside potential |

| Snowflake Inc. Class A |

SNOW, |

227.03 | 61% | $154.29 | $178.95 | 16% |

| Bill Holdings Inc. |

BILL, |

65.93 | 71% | $81.14 | $127.07 | 57% |

| Albemarle Corporation |

ALB, |

7.67 | 57% | $221.04 | $316.96 | 43% |

| Take-Two Interactive Software Inc. |

TTWO, |

22.24 | 78% | $119.30 | $132.63 | 11% |

| DoubleVerify Holdings Inc. |

DV, |

44.66 | 93% | $30.15 | $34.92 | 16% |

| Jamf Holding Corp |

JAMF, |

72.74 | 80% | $19.42 | $27.22 | 40% |

| Ceridian HCM Holding Inc. |

CDAY, |

55.26 | 47% | $73.22 | $84.07 | 15% |

| EQT Corporation |

EQT, |

8.05 | 79% | $31.91 | $46.86 | 47% |

| Definitive Healthcare Corp. Class A |

DH, |

50.58 | 46% | $10.33 | $14.50 | 40% |

| Block Inc. Class A |

SQ, |

35.38 | 75% | $68.65 | $96.34 | 40% |

| Source: FactSet | ||||||

Don’t miss: This stock ETF keeps beating the S&P 500 by selecting for quality

[ad_2]

Source link