‘Alarming reacceleration’ behind Fed’s preferred inflation gauge upends markets

[ad_1]

A fresh round of data on U.S. inflation upended financial markets on Friday, putting to rest any lingering hopes that the Federal Reserve could soon end or at least suspend its continued rate hikes.

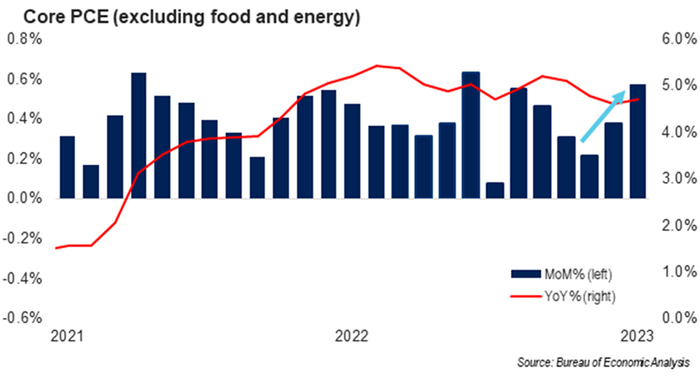

One of the biggest reasons for the reaction is that Friday’s data was based on the Fed’s own preferred gauge of inflation, known as the PCE or personal-consumption expenditures price index, which captures changes in the prices of goods and services purchased by consumers. It includes a more closely followed and less-volatile reading known as core PCE, which strips out food and energy prices; that core reading actually reaccelerated despite almost a full year of Fed rate hikes.

The PCE data is just the latest sign that the Fed’s tightening efforts — which have taken the fed-funds rate to 4.5%-4.75% from almost zero since last March — haven’t been enough to do the trick, and that stock and bond investors may be caught in the same sell-everything turmoil that prevailed for much of 2022.

Traders briefly boosted the chances of a half-point-rate hike in March, to as much as 42% on Friday from 27% a day ago, and pushed Treasury yields higher across the board amid an aggressive bond selloff. All three major U.S. stock indexes

SPX,

COMP,

were sharply lower in afternoon trading, and the ICE U.S. Dollar Index

DXY,

was on pace at one point for its best week since September.

Stock Market Today: S&P 500 heads for third straight weekly loss after hot inflation data

Momentum in the PCE’s core reading, which rose by 0.6% last month and by 4.7% on a 12-month basis, shows an “alarming reacceleration,” FHN Financial macro strategist Will Compernolle said via phone.

“Not only is inflation not improving, but it’s getting worse. Any hopes that we were at least on a good trajectory are gone. We’re not back to square one, but back to panic mode. If inflation is going to remain high and getting worse, there’s no sense that the Fed can slow down anytime soon but will potentially have to get more aggressive,” Compernolle said.

Source: Bureau of Economic Analysis

The risk that U.S. interest rates could rise above 5% by March, the highest level since 2006, gained some traction on Friday.

Investors and traders had begun the year mostly hopeful that the Federal Reserve would peak around 4.9% in 2023 after inflation showed signs of slowing. Over the past three weeks, though, the market’s expectations have moved closer in line with policy makers’ forecast for 5%-plus rates this year.

January’s blowout U.S. jobs report, released on Feb. 3, nudged up expectations around the world for how high major central banks are likely to take rates, and moved the needle on many people’s thinking about how persistent inflation is likely to remain. That report was then followed by an update on consumer prices that fanned inflation fears, and a surprisingly strong retail sales report.

“The U.S. economy has been more resilient than expected, but a robust U.S. economy partnered with above-target inflation may raise the risk of a later, deeper recession as the Fed tries to combat inflation by continuing to hike rates,” said Mark Haefele, chief investment officer at UBS Global Wealth Management.

Investors “should diversify beyond the U.S. and growth stocks,” he said in an email, noting that UBS Global Wealth likes emerging-market equities and value stocks. Haefele said investors will “need to take a more regionally selective approach to risk decisions, rather than make blanket ‘risk-on’ or ‘risk-off’ calls.”

After Friday’s data, traders boosted the chances that the fed-funds rate could peak at just under 6% by July. At one point, fed-funds futures reflected an 8.6% likelihood of that happening, up from 4.2% a day ago, and were showing a less-than-1% chance that rates could get to between 6% and 6.25% by then.

Those prospects tapered off as the day wore on, when Cleveland Fed President Loretta Mester said she didn’t want to “prejudge” whether she would support a half-point rate hike in March.

Remarks by at least one other Fed official on Friday, though, only underscored lingering worries about higher-for-longer interest rates: Fed Gov. Philip Jefferson said high inflation may come down “only slowly.”

Meanwhile, bond-market gauges of impending U.S. recessions continued to flash warnings. The 2-year Treasury yield

TMUBMUSD02Y,

jumped further above the 10-year rate

TMUBMUSD10Y,

inverting the spread between the two rates to minus 83.6 basis points on Friday. The spread between 5-

TMUBMUSD05Y,

and 30-year yields

TMUBMUSD30Y,

also went more deeply negative, at minus 28 basis points.

“This morning’s data exacerbates anxiety about inflation as being not under control as previously thought, and reinforces the idea that the Fed was closer to reality than the markets were,” said FHN Financial’s Compernolle.

Friday’s PCE data “gives more ammunition to the idea that the peak fed-funds rate needs to be closer to 6% by around June,” Still, “this is just one month of data and for the Fed to reaccelerate rate hikes based on just this one report would send the signal to the market that the Fed doesn’t have things under control.”

[ad_2]

Source link