U.S. stock futures start week with advance after latest relapse

[ad_1]

U.S. stock futures pointed to Wall Street bouncing off five-week lows as Treasury yields eased.

How are stock-index futures trading

-

S&P 500 futures

ES00,

+0.47%

rose 14 points, or 0.4%, to 3990 -

Dow Jones Industrial Average futures

YM00,

+0.41%

added 106 points, or 0.3%, to 32932 -

Nasdaq 100 futures

NQ00,

+0.56%

climbed 58 points, or 0.5%, to 12055

On Friday, the Dow Jones Industrial Average

DJIA,

fell 337 points, or 1.02%, to 32817, the S&P 500

SPX,

declined 42 points, or 1.05%, to 3970, and the Nasdaq Composite

COMP,

dropped 195 points, or 1.69%, to 11395.

What’s driving markets

Buyers set the stage early on Monday, delivering small gains for stock index futures. The nascent rally comes after U.S. equities fell to a five-week low amid signs that relatively robust economic activity is helping keep inflation stubbornly high.

“The U.S. economy is proving much more durable than many market participants expected just a few months ago,” said Stephen Innes, managing partner at SPI Asset Management.

The PCE inflation measure released on Friday showed price pressures remain elevated, reducing the chances that the Federal Reserve will consider easing monetary policy anytime soon and thus forcing bond yields higher.

“The U.S. yield reset is bulldozing through global risk markets as a combination of hotter inflation, better growth sentiment, and hawkish policy have most investors heading for the bunkers while others are seeking out the relative safety of the still highly valued U.S. dollar,” Innes added.

U.S. economic updates set for release on Monday include January durable goods orders at 8:30 a.m. Eastern and January pending home sales at 10 a.m. Eastern. Fed Governor Phillip Jefferson is due to speak at 10:30 a.m.

The S&P 500 has lost 4% over the past three weeks as the monetary-policy sensitive 2-year Treasury yield

TMUBMUSD02Y,

moved above 4.8%, near to 15-year highs. However, yields are a touch softer on Monday, and this is helping sentiment toward stocks as the fresh week begins.

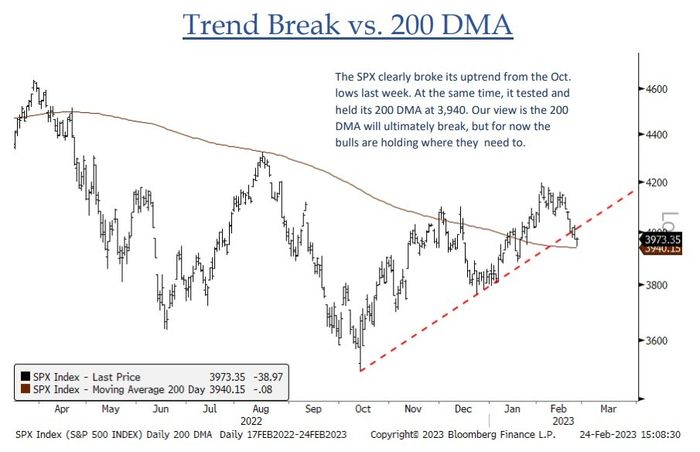

Still, Jonathan Krinsky, chief technical strategist at BTIG, is wary of further downside for stocks.

Source: BTIG

“While it was holiday shortened, the SPX suffered its worst decline of the year last week (-2.67%) as momentum continues to rollover. As a result, it essentially tested its 200 day moving averae (3940) and got down to the high volume zone (3925-3950) of the last few years. While these areas are likely to provide some support in the near-term, we expect an eventual breakdown below which would open the door to Dec. lows (3775),” Krinsky wrote in a note to clients.

[ad_2]

Source link