Big banks got hammered on Thursday – but Goldman says there’s opportunity lurking.

[ad_1]

Markets are in a bit of a funk again. To the tension generated by recently surging bond yields and a looming jobs report, we can add a seemingly old fashioned bass-slapping wobble about bank contagion.

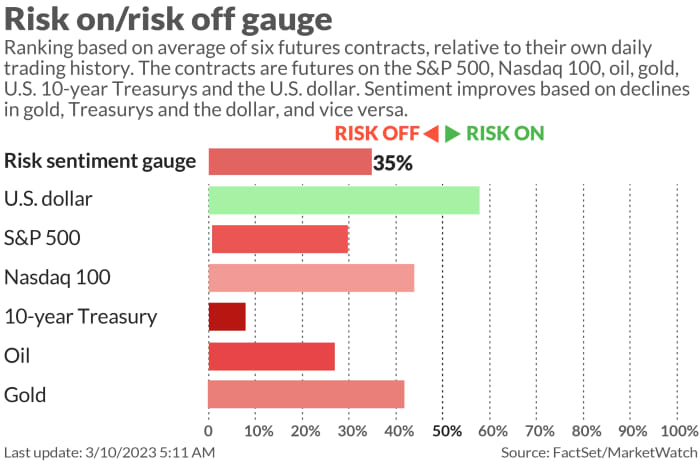

Yet, study the dollar. As shares in Silicon Valley Bank

SIVB

cratered Thursday, and sparked a landslide across the sector, the buck

DXY,

normally the primary haven at times of intense angst, did not rally.

Does this mean traders think the funk is U.S.-centric and should thus damage the dollar? Or does it imply we are not anywhere near George Clinton levels of planetary funkiness and so a rush to the greenback is not required?

Goldman Sachs thinks the latter and is playing the easy listening music.

In a note published late Thursday, the bank said problems illustrated by SVB are “idiosyncratic, not systemic.”

Goldman’s credit strategy research team, led by Lotfi Karoui, recognizes there is, of course, a problem for SVB and others caused by the sharp inversion of the bond curve, a move triggered by the Federal Reserve’s rapid hiking of interest rates to suppress inflation.

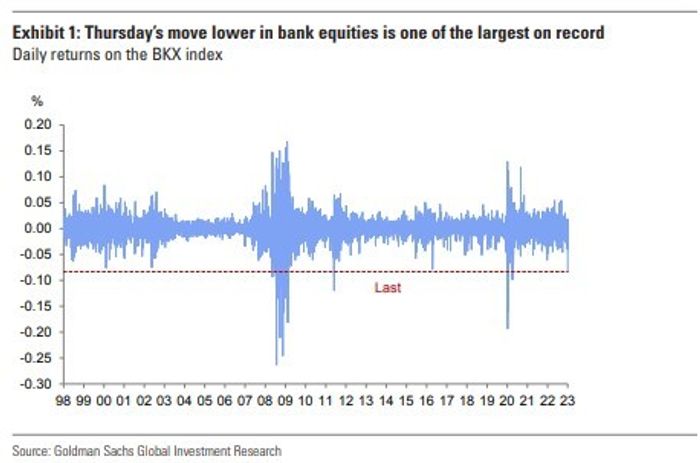

“To put things in context, and leaving aside the global financial crisis, today’s [Thursday’s] move lower in the equity bank sector index is the third largest of the last 25 years, after the 2020 COVID period and August 2011 in the wake of the US government rating downgrade,” says Goldman.

Source: Goldman Sachs

Smaller, regional banks were particularly badly hit. But shares of big U.S. banks and those of foreign banks with large U.S. operations, known as Yankee banks, performed relatively better, and Goldman says: “We reiterate our overweight recommendation on the sector and would use any large selloff as an opportunity to add risk.”

It gives three reasons for this call.

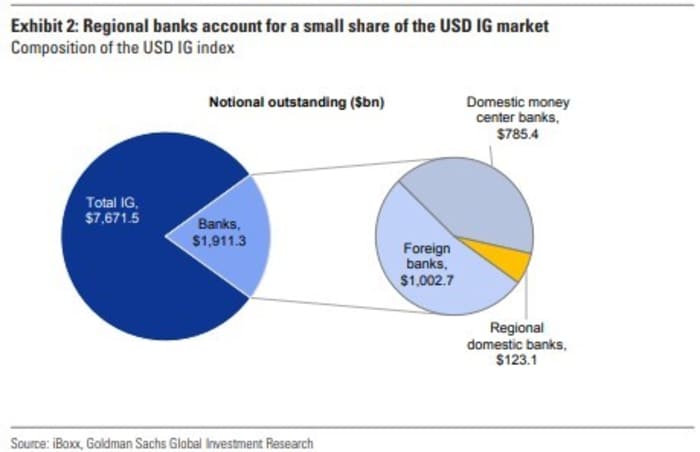

First, strategists believe the risk of debt contagion from the small banks to big ones is remote, given the low share of regional banks in the investment grade (IG) index.

“[W]hile the banking sector does make up a large share of the USD IG market at 25% of the notional outstanding, regional domestic banks only make up 6% of the banks sector, or about 1.5% of the broader USD IG market.”

Source: Goldman Sachs

Second, Goldman says the regional banks’ low share is itself “quite diversified, with 15 issuers and no one issuer accounting for more than 20% of the notional outstanding.”

Finally, big banks are more robust following tougher regulation over recent years.

“[W]e think the risk that large U.S. or Yankee banks experience a capital or liquidity event driven by assets/liabilities mismatches or concentrated positions on securities portfolios is remote, considering the post-global financial crisis regulatory environment.”

Now, there will be skeptics who note that a big bank is predisposed to claiming that big banks will be fine. Yet some commentators are sufficiently convinced that this latest episode is merely an obscure sub-genre of crypto/VC funk that even the regionals are attractive.

Kevin Muir, who writes the Macro Tourist blog, said he plans to open a large overweight position in the S&P Regional Banking exchange traded fund on Friday.

“I think this indiscriminate bank selling is overblown and is the result of Great Financial Crisis-scars,” he says.

“Of course, there are losses from the Fed’s aggressive policies sitting on banks’ balance sheets, but on the whole, banks are not as foolish as the market believes. Just because two overly aggressive tech banks [SVB and Silvergate

SI

] got themselves into trouble doesn’t mean the whole sector is tainted. The market always hedges for the last crisis, and I am willing to bet that banks aren’t the source of the next crisis,” says Muir.

Markets

Wall Street is in line for another soft session with S&P 500 futures

ES00

off 0.3%, and Dow futures

YM00

down over 100 points, while benchmark 10-year Treasury yields

BX:TMUBMUSD10Y

dipped 4 basis points to 3.871%. The dollar index

DXY

is down 0.1% and gold

GC00

is up 0.3% to $1,840.30 an ounce. Bitcoin

BTCUSD

is under $20,000.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

It’s Jobs Friday again – delayed a week because last week March crept up a bit fast for some! Economists forecast a net 225,000 net positions were created in February, down sharply from January’s astounding 517,000 gain, but still probably too robust to be compatible with the Fed’s desire to damp inflation.

The unemployment rate is expected to say the same at 3.4% and average hourly wage growth is forecast to move up 0.4% over the month, a touch faster than the 0.3% seen in January.

Oracle shares

ORCL

are off nearly 4% in premarket action after the software group’s results contained disappointing revenues.

Former work-from-home darling DocuSign

DOCU

delivered better-than-expected results after Thursday’s closing bell but its shares are down more than 10% in the premarket.

Bank of Japan governor Haruhiko Kuroda surprised no one by keeping monetary strategy unchanged, and ultra-loose, at his last policy board meeting before handing over the reins to Kazuo Ueda in April.

The pound

GBPUSD

is firmer after data showed the U.K. economy grew by 0.3% between December and January, beating forecasts of a 0.1% expansion, with activity helped by the return of Premier League soccer after the World Cup.

Best of the web

Reinventing Penn Station: can New York still do big things?

Elon Musk is planning a Texas Utopia — his own town.

Avengers!…er…do not assemble! There may be fewer Marvel sequels in Disney’s future says Bob Iger.

The chart

In this Tweet from Richard Farr, chief market strategist at Merion Capital Group, the yield on 6-month T-bills are the red line and the market’s price/earnings ratio the blue. Message: the stock market will go down more.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| SIVB | SVB Financial |

| TRKA | Troika Media |

| BBBY | Bed Bath & Beyond |

| AMC | AMC Entertainment |

| GME | GameStop |

| AAPL | Apple |

| SI | Silvergate Capital |

| NVDA | Nvidia |

| NIO | NIO |

Random reads

Pedro Pascal’s coffee order has fans fearing for his welfare.

More celebration of glorious British cuisine.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

[ad_2]

Source link