Bonds are right and stocks are wrong. Here’s what you should do about it, says BlackRock

[ad_1]

The final session of Wall Street’s holiday-shortened trading week will see the S&P 500 open pretty much smack in the middle of the 3,800 to 4,200 range it’s inhabited for more than three months. Dips keep getting bought and rips sold.

The good news for bulls is that the benchmark equity index

SPX

remains up 4.5% for the year and has gained 12.2% from the October trough.

However that rebound is based on a narrative of incompatible outcomes, which ultimately may be bad news for risk assets, warns Blackrock.

But first, why the rally? The team at BlackRock Investment Institute Risk led by Jean Boivin, notes that assets jumped at the start of 2023 thanks to falling inflation, lower energy prices in Europe, China’s rapid re-opening as COVID restrictions were lifted, and what it terms technical factors – i.e. many investors were overly bearishly positioned.

“Yet we think the rally also reflects hopes that the sharpest central bank policy tightening in decades can avoid economic damage: growth will be sustained even if rates stay higher, and inflation will drop to 2% targets. Central banks then wouldn’t need to further tighten policy and create recessions to lower inflation,” says BlackRock.

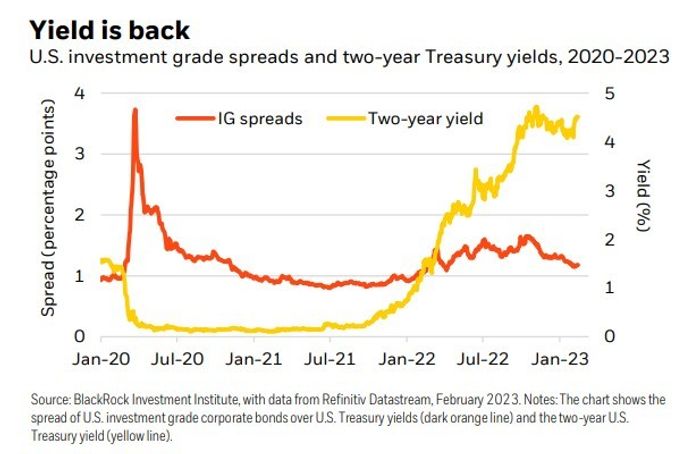

The stock market appears, mostly, to still believe this. Yet 2-year Treasury yields

BX:TMUBMUSD02Y,

which are particularly sensitive to Federal Reserve monetary policy, sit near their highest since 2007, having jumped nearly 50 basis points so far in February.

“Now bond markets are waking up to the risk the Fed hikes rates higher and holds them there for longer,” says BlackRock.

With recent data showing economic activity is holding up well — see the robust labor market –and core inflation is proving stickier than expected, BlackRock doesn’t think inflation is on track back to the Fed’s 2% target without a recession.

“That means solid activity data should be viewed through its implications for inflation. In other words: Good news on growth now implies that

more policy tightening and weaker growth later is needed to cool inflation. That’s bad news for risk assets, in our view,” says BlackRock.

Because the asset manager reckons this is not a typical economic cycle, it thinks “a new investment playbook is needed.”

It suggests going overweight short-duration Treasuries, which offer three times more than the 1.5% they were providing just a year ago. “We also like their ability to preserve capital at higher yields in this more volatile macro and market regime.”

Source: BlackRock

Exposure to investment grade credit should be reduced because the recent risk asset rally has caused credit spreads to tighten too much, suggesting investors are too sanguine.

In equities, BlackRock favors emerging markets

EEM

over developed: “We prefer EM as their risks are better priced: EM central banks are near the peak of their rate hikes, the U.S. dollar is broadly weaker in recent months and China’s restart is playing out.”

“That is in contrast to major economies that have yet to feel the full impact of central bank rate hikes – and yet still have a too-rosy earnings outlook, in our view. Plus, the risk is growing that DM central banks press ahead with more rate hikes.”

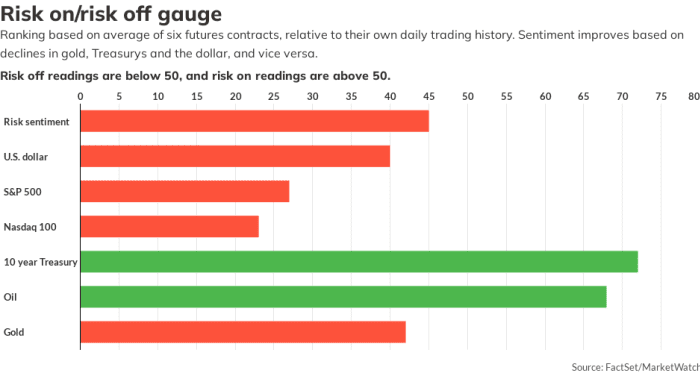

Markets

Stock-index futures indicate a soft opening, with the S&P 500 contract

ES00

off 0.4% and the Nasdaq 100

NQ00

easing 0.8%. The U.S. 10-year Treasury yield

BX:TMUBMUSD10Y

is up 2.3 basis points to 3.905%, close to a three month high. The dollar index

DXY

is adding 0.1% to 104.67.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

On the first anniversary of Russia’s invasion of Ukraine the Chinese government called for a ceasefire and proposed a peace plan. Beijing this week refused to back a UN vote condemning Moscow’s invasion. China’s leader Xi Jinping has not called Ukraine’s president Volodymyr Zelenskyy since Russia’s invasion but has spoken with Vladimir Putin on several occasions.

There’s quite a lot of economic data and Fedspeak for traders to consider on Friday. Arguably of most importance is the personal consumption expenditure price index for January, due at 8:30 a.m. The PCE index is a favored inflation gauge of the Federal Reserve.

Consumer spending and personal income data for January will also be published at 8:30 a.m. followed at 10 a.m. by January new home sales and the final reading on consumer sentiment for February.

Fed Governor Phillip Jefferson is due to speak at 10:15 a.m., the same time as Cleveland Fed President Loretta Mester. At 11:30 a.m. St. Louis Fed President James Bullard will make some remarks, followed at 1:30 p.m. by Boston Fed President Susan Collins and Fed Governor Christopher Waller.

Two badly beaten down former stock darlings are having a better time in premarket trading. Shares in Beyond Meat

BYND,

which were well above $200 in 2019, are jumping 14% to flirt with $20 after delivering better than expected results.

Meanwhile, Block

SQ

is up more than 7% to near $80 after the payment technology group’s earnings were well received. Block’s stock was above $275 in August 2021.

Adobe shares

ADBE

are off 3% following a report the DOJ was looking to block the company’s $20 billion purchase of Figma .

Best of the web

Eight ways the Russia-Ukraine war changed the world.

Timing the market is a loser’s game.

We must keep fighting Russia with banks as well as tanks, says Browder.

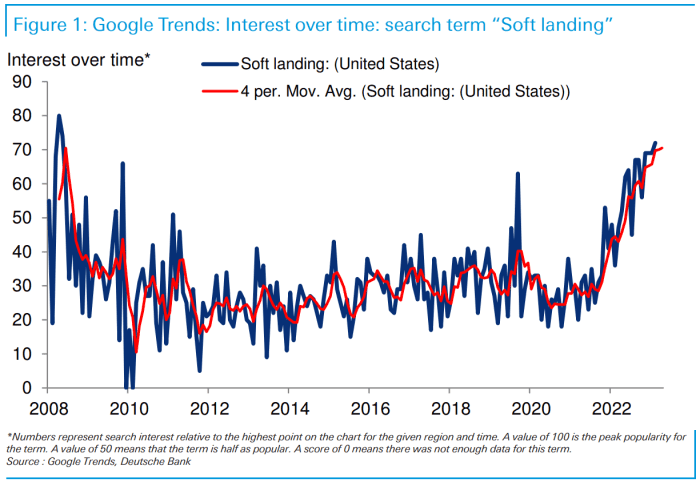

The chart

As alluded to above, one of the reasons that stocks had a good start to the year was that investors began to think the U.S. economy could escape the Fed’s tightening cycle with a “soft landing.” As the chart below from Deutsche Bank shows, U.S.-based searches on Google for the phrase reached a 15-year high this month. And we all know what tends to open when an idea in markets becomes overly popular.

Source: Deutsche Bank

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| AMC | AMC Entertainment |

| BBBY | Bed Bath & Beyond |

| NVDA | Nvidia |

| GME | GameStop |

| LUNR | Intuitive Machines |

| NIO | NIO |

| AAPL | Apple |

| APE | AMC Entertainment preferred |

| MULN | Mullen Automotive |

Random reads

California man claims winning $2.04 billion Powerball ticket was stolen from him.

80-year janitor can now re-retire after students raise $200,000.

Ryan Reynolds to take the field for Wrexham FC.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

[ad_2]

Source link