Here are two theories on why the economy will continue to be scorching, and what that means for stocks and bonds.

[ad_1]

All this “soft” data is bad, but the hard stuff is anything but. Pretty much everything apart from housing has come up strong of late. The Atlanta Fed’s GDPNow estimate, which does take the ISM data into account but also blends in harder data, is estimating 2.3% growth in the first quarter, which perhaps signals it’s time to throw some of this soft data out the window. For example, the Conference Board’s expectations index has been below that 80 mark for 11 of the last 12 months.

The question of what is making the economy so strong in the face of aggressive Federal Reserve interest-rate hikes and jaw-dropping inflation is obviously puzzling everyone, particularly as pandemic savings which have been estimated at about $2.3 trillion are being wound down.

Kevin Muir, who pens the Macro Tourist blog, asked the question of why the economy is so strong in a post this week. One thing he highlighted is the stimulus still to hit the U.S. economy. This will come not from the federal government but from states. He cites Alabama’s treasurer, Young Boozer (yes), who reportedly said that states will have over $1 trillion to spend on infrastructure over the next three to five years.

Muir also says the bond market, and economists, may just have underappreciated the power of fiscal stimulus that has been unleashed. That comment leads nicely to a new paper, from three research fellows at the National Bureau of Economic Research, who say that the mass stimulus isn’t being fully recognized.

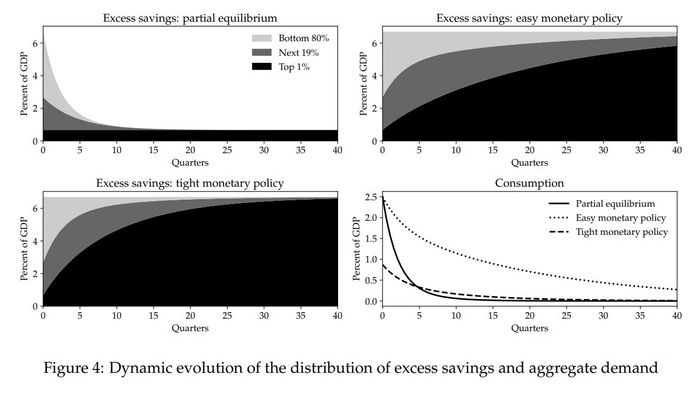

It’s not just that consumers get a check from Uncle Sam and then go out and spend it. That spending is someone else’s income, which means, in their words, “excess savings from debt-financed transfers have much longer-lasting effects than a naive calculation would suggest.” This excess savings, to reverse a popular saying, is “trickling up.”

Auclert/Rognlie/Straub

One of the co-authors, Harvard University assistant professor of economics Ludwig Straub, took to Twitter to explain it in plain English. “One person’s spending is another person’s income … So your stimulus check gets spent again…and again…etc. This way the Covid stimulus can slosh around the U.S. economy for a very long time, raising demand and inflation,” he says. That process ends once that income is mostly in the hands of rich people, who have a lower propensity to consume. That is, unless the U.S. goes out and aggressively pays down the debt taken out to finance this spending.

So, how long will that process take? Five years in total, the researchers say, even with tight monetary policy and high inflation. They even provided their model to the public.

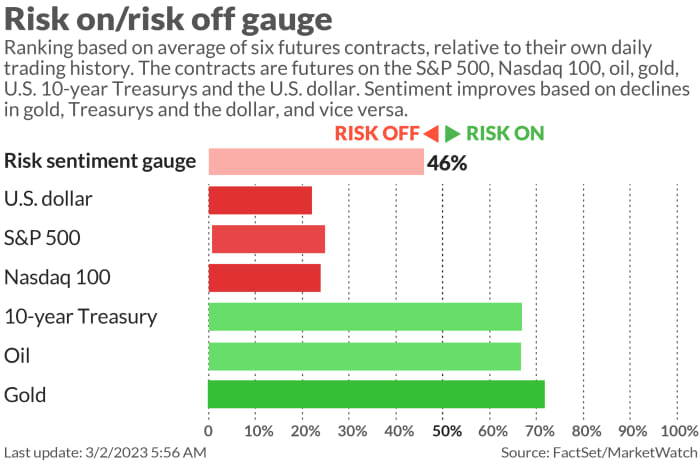

A popular Twitter finance account, @InArteCarlosDoss, describes a hot scenario like this as the “big flip.” The account, who identified as an independent trader to MarketWatch, says that’s associated with sticky inflation, a resilient consumer and a resilient economy, and says that the stock and bond markets have both mispriced this. In such a scenario, the trader expects tech to underperform, bonds to resume their downtrend, and the dollar to resume its uptrend, providing a headwind to risky assets.

The markets

U.S. stock futures

ES00

NQ00

were pointing to more pain in store with the yield on the 10-year Treasury

BX:TMUBMUSD10Y

holding over 4%. The U.S. dollar

DXY

rose as well.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Tesla shares

TSLA

fell 6% after the electric vehicle maker’s investor day. Jessica Caldwell, executive director of insights at Edmunds, said “Musk and company failed to put the cherry on top—an actual look at a lower-priced Tesla, if only just conceptually.” STMicroelectronics shares

STM

dropped 6% in Milan trade as Tesla said it will use 75% less silicon carbide chips in upcoming models.

Also on the EV front, Rivian

RIVN

may have set a record for cash burn from a startup.

Salesforce.com

CRM

shot up 15% as the Dow industrials component and enterprise software provider forecast earnings well above Wall Street estimates. Other tech companies that reported late on Wednesday included identity-management company Okta

OKTA,

database firm Snowflake

SNOW

and data storage company Pure Storage

PSTG.

Macy’s shares

M

rallied after better-than-forecast results from the department-store operator.

Silvergate Capital

SI

shares slumped 30% as the bank delayed filing its annual report and said it was evaluating its ability to continue as a going concern. Signature Bank

SBNY,

also a lender to crypto companies, fell 6%.

The economics calendar includes fourth-quarter productivity data and weekly jobless claims. Eurozone inflation decelerated but came in hotter than forecast in February.

Best of the web

Communities are saying “no” to dollar stores.

Many tech workers have been laid off — but a growing number have just quit.

There’s a growing exodus of companies from the London Stock Exchange

UK:LSEG

to the New York Stock Exchange, a unit of the Intercontinental Exchange

ICE.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| BBBY | Bed Bath & Beyond |

| AMC | AMC Entertainment |

| GME | GameStop |

| NIO | Nio |

| TRKA | Troika Media |

| AAPL | Apple |

| NVDA | Nvidia |

| APE | AMC Entertainment preferreds |

| AMZN | Amazon.com |

Random reads

This Saturday Night Live star says longtime producer Lorne Michaels gave her this unique bit of financial advice.

A man survived adrift at sea on just ketchup.

The hot new fashion is pasta puffers.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link