It’s too early to start buying stocks again, says Morgan Stanley’s Mike Wilson

[ad_1]

Judging by stock futures, one wouldn’t guess we’ve come off a wild weekend that joined up two of Switzerland’s biggest banks, one in deep trouble. A flat to slightly lower start is ahead for Wall Street, but oil prices are under pressure and gold is up a lot.

As for recent events on U.S. shores, the failure of three U.S. banks “represent the amplification of a longer-running predicament. They put the Fed in a deeper policy hole and make this week’s decision on U.S. interest rates particularly important,” Mohamed A. El-Erian, chief economic adviser at Allianz, writes in the FT.

That all brings us to our call of the day, from Morgan Stanley’s chief U.S. equity strategist Mike Wilson who tells us exactly what that U.S. rescue for bank depositors doesn’t mean — a quantitative easing.

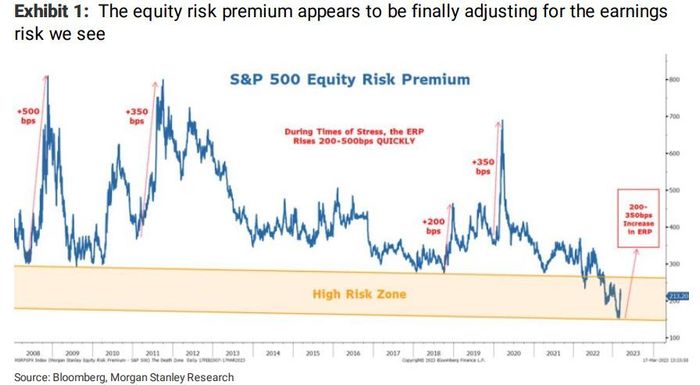

“From an equity market perspective, the events of the past week mean that credit availability is decreasing for a wide swath of the economy, which may be the catalyst that finally convinces market participants the equity risk premium (ERP) is way too low,” says Wilson.

He’s referring to a gauge that says stocks just aren’t worth the risk, especially when investors can get more bang for their buck out of Treasurys and high-grade bonds.

“We have been waiting patiently for this acknowledgement because with it comes the real buying opportunity,” said Wilson, who notes that the S&P 500’s

SPX

current ERP is around 220 basis points. “Given the risk to the earnings outlook, risk/reward in U.S. equities remains unattractive until the ERP is at least 350-400bp, in our view.”

Observe his chart:

Wilson believes Wall Street’s gains last week came from a misinterpretation of action by U.S. officials. “We think it had to do with the view we have heard from some clients that the Fed/FDIC bailout of depositors is a form of quantitative easing (QE) and provides the catalyst for stocks to go higher,” he said.

“While the massive increase in Fed balance sheet reserves last week does reliquefy the banking system, it does little in terms of creating new money that can flow into the economy or the markets, at least beyond a brief period of, say, a few days or weeks,” Wilson added.

After all, the Fed is lending, not buying. “If a bank borrows from the Fed, it is expanding its own balance sheet, making leverage ratios more binding. When the Fed buys the security, the seller of that security has balance sheet space made available for renewed expansion. That is not the case in this situation,” said Wilson.

The Fed’s weekly release of its balance sheet on Wednesday showed it’s lent out $308 billion to depository institutions, a $303 billion gain over the previous week. Of that, part was primary credit via the discount window, part represented loans to bridge banks. Wilson said that money is unlikely to transmit to the overall economy like normal bank deposits.

“Instead, we believe the overall velocity of money in the banking system is likely to fall sharply and more than offset any increase in reserves, especially given the temporary/emergency nature of these funds,” said Wilson.

“The uninsured deposit backstop put in place last weekend by the Fed/FDIC will help to alleviate further major bank runs, but it won’t stop the already tight lending standards across the banking industry from getting even tighter. It also won’t prevent the cost of deposits from rising, thereby pressuring net interest margins. In short, the risk of a credit crunch has increased materially,” he said.

As a reminder, Morgan Stanley’s strategist, nicknamed “worried Wilson,” earned plaudits on Wall Street for correctly anticipating the 2022 bond and stock selloff — the S&P 500’s worst year since 2008. For 2023, he’s among the most pessimistic, forecasting a 3,900 finish for the index.

Read: Why the collapse of Silicon Valley Bank was not a black swan

The markets

Stock futures

ES00

NQ00

trimmed losses, and the 2-year Treasury yield

TU00

has pared a steeper drop to 5 basis points. Crude prices

CL

are down 3%, while gold

GC00

is up 0.8%, touching above $2,000 an ounce at one point this morning. The dollar is up a bit. European equities

XX:SXXP

are mostly lower.

Bitcoin

BTCUSD,

meanwhile, has eased back from $28,000, but remains at levels not seen since June.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

A frantic weekend of deal-making ended with Sunday’s $3.25 billion takeover of Credit Suisse

CS

by rival UBS

UBS,

engineered by Swiss authorities, with some help by the Fed. UBS shares tumbled, and the ADR is down 8%, with Deutsche Bank

DB

down 4% and HSBC

HSBC

off nearly 3%. Still trading Credit Suisse shares are off 56%.

“The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient,” Fed Chair Jerome Powell and Treasury Secretary Janet Yellen said as they applauded the Swiss deal.

Almost simultaneously on Sunday, the Fed, Bank of Japan, Bank of Canada, Swiss National Bank and ECB announced a coordinated move to keep U.S. dollars flowing by increasing liquidity for U.S. dollar swap arrangements.

The latest U.S. bank development: Flagstar Bank , a unit of New York Community Bankcorp

NYCB

said it would take over most of failed Signature Bank’s

SBNY

deposits and some loans.

A two-day Fed meeting wraps Wednesday. Goldman Sachs now forecasts a pause by the Fed, while the futures market is putting greater odds on a quarter-point increase.

Best of the web

The planet is nearing the point of no return, a new UN climate report will say.

The chart

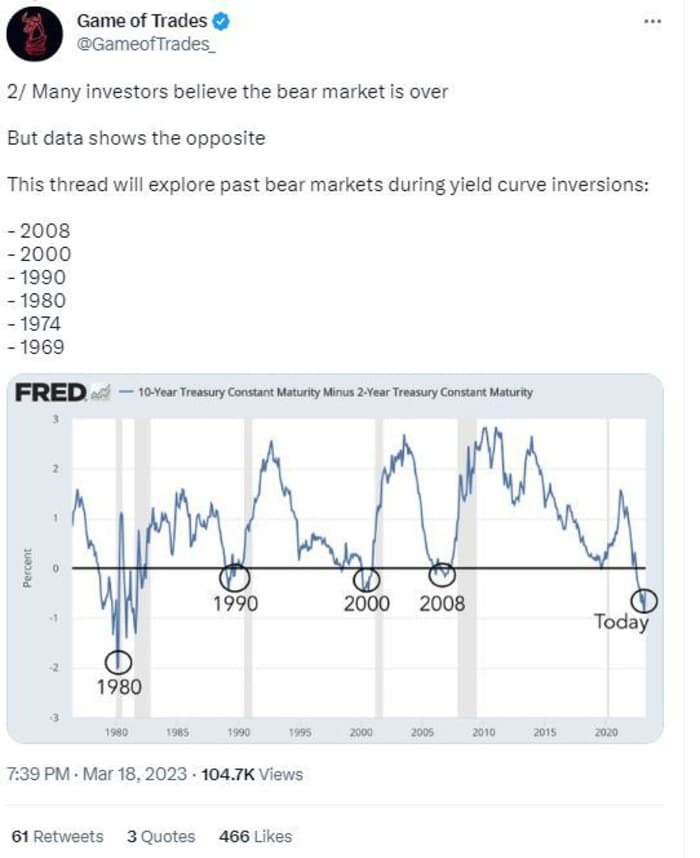

More bear-market talk:

@GameofTrades_

@GameofTrades_

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

| FRC | First Republic Bank |

| TSLA | Tesla |

| CS | Credit Suisse |

| BBBY | Bed Bath & Beyond |

| GME | GameStop |

| UBS | UBS |

| AMC | AMC Entertainment Holdings |

| CH:CSGN | Credit Suisse |

| NVDA | Nvidia |

| AAPL | Apple |

Random reads

History buff renovating his kitchen discovers 400-year old paintings.

Need to Have: Mind-reading beer pump.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

[ad_2]

Source link