Jay Powell is not your friend. Here’s how to trade that.

[ad_1]

A calmer end to the week would be nice. The previous two sessions saw the S&P 500

SPX

vacillate wildly; on Wednesday jumping 0.9% before finishing down 1.6%; and Thursday, surging 1.8% before closing off 0.5%.

Uncertainty about Federal Reserve policy and the banking sector appear to have caused the wobbles, which may be returning this morning thanks to Deutsche Bank.

And with that in mind one might consider popping this trade in your diary.

Date: May 3rd 2023. Action: When the S&P 500 bounces after the Federal Reserve’s rate decision, fade it.

The chances of that strategy paying off are pretty good according to these charts from Bespoke Investment Group. In particular, it’s Fed Chair Jay Powell’s press conference that seems to coincide with the wheels falling off the rally wagon.

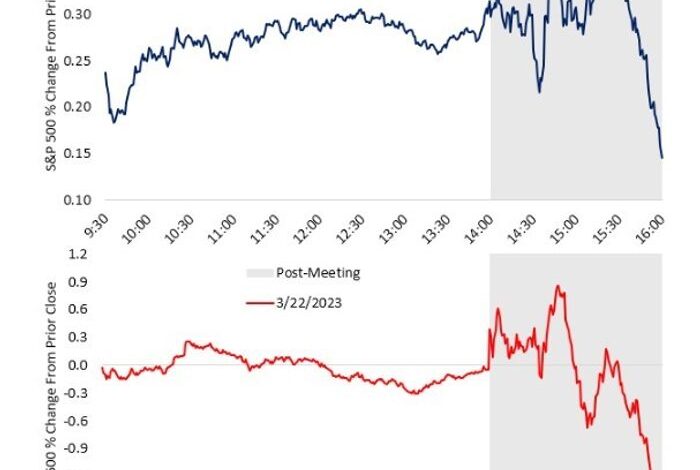

“Yesterday [Wednesday] was the 42nd FOMC decision (Fed Day) since Powell became Fed Chair, and we created a chart showing the average path that the S&P has taken intraday on all 42 of these Powell Fed Days. What we found was pretty remarkable,” said Bespoke.

Source: Bespoke Investment Group.

Now, to be fair, the relapse shown for the stock market on Wednesday (bottom chart) may have had more to do with Treasury Secretary Janet Yellen nixing the idea of a blanket bank deposit protection scheme.

But still, Powell now has form as an equity Jonah. Remember when he was deemed the market’s friend? No more. Soaring inflation will do that to a man.

The good news for those traders not prepared to wait till the next Fed meeting is that the market tends to bounce over the several sessions following a Powell plunge, Bespoke notes.

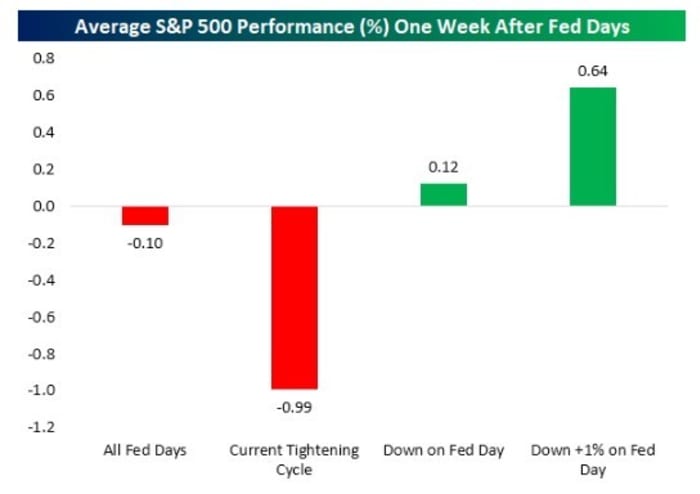

Source: Bespoke Investment Group

“Since 1994 when the Fed began announcing policy decisions on the same day as its meeting, the S&P has averaged a decline of 10 basis points over the next week. During the current tightening cycle that began about a year ago, market performance in the week after Fed days has been even worse with the S&P averaging a decline of 0.99%,” says Bespoke.

“However, when the S&P has been down over 1% on Fed days, performance over the next week has been positive with an average gain of 0.64%,” Bespoke adds.

As Bespoke stresses: past performance is no guarantee of future results. And obviously a lot can change by the beginning of May. For a start, sentiment in bond markets, which has been a main driver of equity action of late, may have shifted considerably.

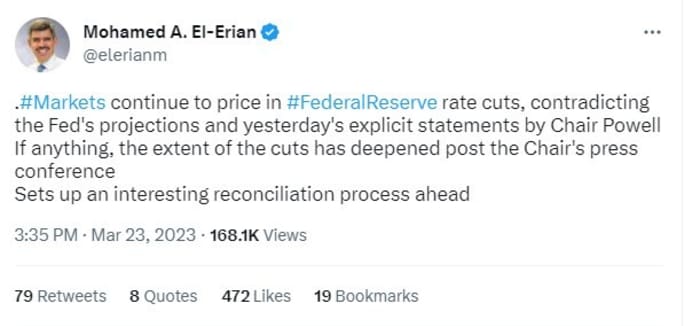

As Mohamed El-Erian, adviser to Allianz and Gramercy, notes in a tweet following the Fed decision, either the Fed or the market is wrong about where interest rates are going later in the year.

Unlike many high-profile commentators El-Erian is a stranger to hyperbole, so his conclusion that the current dichotomy “sets up an interesting reconciliation process ahead” can be translated for market trading purposes into something one might hear from billionaire investor Bill Ackman these days: “There will be blood!”

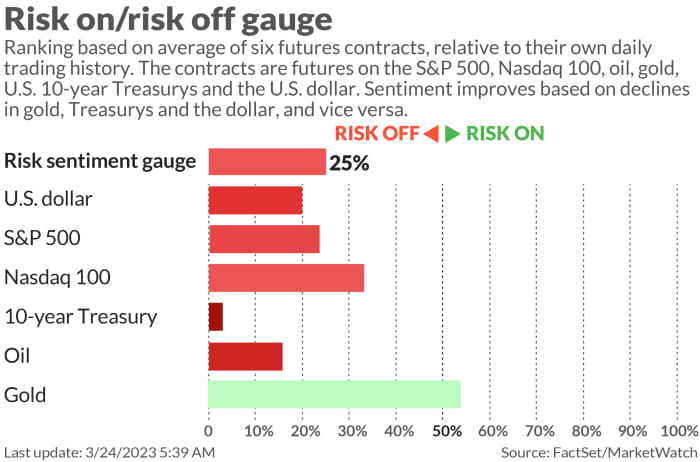

Markets

S&P 500 futures

ES00

fell 0.7% as European banking stress impacted sentiment. The broader marker stress encouraged investors to seek safety in Treasuries, pushing 10-year yields

BX:TMUBMUSD10Y

down 10 basis points to 3.319%, and the dollar

DXY,

up 0.4% to 102.93.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

Shares in Deutsche Bank

XE:DBK

are leading another sell-off for European banks as worries about contagion in the sector bubble to the surface again following last weekend’s forced marriage of UBS

CH:UBSG

and Credit Suisse

CH:CSGN.

Economic data due on Friday include the advanced February readings of the U.S. trade balance in goods, retail inventories and wholesale inventories, all published at 8:30 a.m. The S&P Case-Shiller home price index for January is released at 9 a.m. alongside the January FHFA home price index. Finally, the March consumer confidence report will be published at 10 a.m. All times Easter.

Cathie Woods ARK funds have snapped up shares in Block

SQ

after they dived on Thursday, following a negative report from short-seller Hindenburg Research.

Bank of England Governor Andrew Bailey on Friday warned companies that if they keep raising prices then he will keep putting up interest rates. U.K. inflation was shown this week to have risen in February to 10.4% and Bailey’s comments suggest the central bank feels corporations need to accept narrower margins if inflation is to be curtailed.

Do Kwon, the former CEO of Terraform Labs, whose stablecoin TerraUSD crashed last year, has reportedly been charged with fraud by the U.S. after being arrested Thursday morning in Montenegro.

Best of the web

Starbucks’s new CEO trained as barista to prepare for role.

Billionaire Zara founder races to spend his ever-growing bounty.

Culture clash: the challenge of uniting fierce rivals UBS and Credit Suisse.

The chart

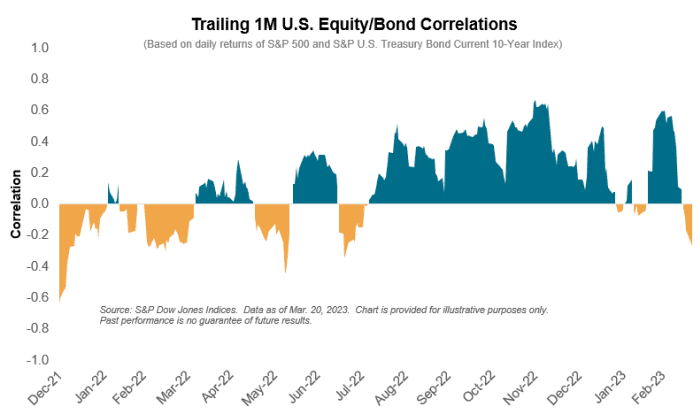

A big problem for investors last year was that both stocks and bonds got clobbered together, wrecking the supposed hedge that a portfolio of 60% equities/40% fixed income is supposed to provide. The good news — as the chart below from Benedek Vörös, director of index investment strategy at S&P Dow Jones Indices, shows — is that the correlation between the S&P 500 and Treasuries is now at its lowest since July 2022.

Source: S&P Dow Jones Indices.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| FRC | First Republic Bank |

| BBBY | Bed Bath & Beyond |

| AMC | AMC Entertainment |

| NVDA | Nvidia |

| TRKA | Troika Media |

| AAPL | Apple |

| SQ | Block |

| NIO | Nio |

Random reads

$148 to go bowling is pretty bad…

…but in New York the $3 frankfurter shows inflation is the wurst.

Paltrow trial judge nixes treats for court security.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

[ad_2]

Source link