The end of easy money is bad news for these stock sectors, says Evercore ISI

[ad_1]

The utility and real estate sectors are most at risk from the end of easy money, but healthier household balance sheets should support consumer-facing stocks, say strategists at Evercore ISI.

The worldwide surge of inflation “has forced the Fed and global central banks to hike rates at a record pace,” Evercore’s equity and derivatives strategy team, led by Julian Emanuel, said in a note that published over the weekend.

The faster pace of inflation and higher central bank policy rates has clobbered bond prices and forced up yields.

“The end of the 40-year bond bull market and ensuing surge in borrowing costs poses risks to leveraged players that have grown accustomed to low cost debt,” said the strategists.

This may be particularly problematic for those sectors that tend to carry greater levels of debt, also known as being highly leveraged.

“As rates have risen, market yields are now well above current coupon rates, suggesting corporates that rely heavily on debt are likely to see a step up in their effective interest expenses.”

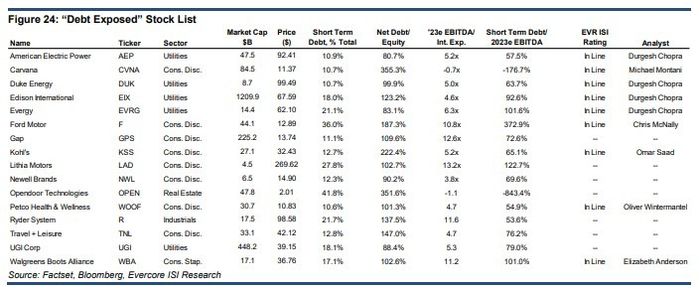

Sectors most at risk from this scenario — what Evercore dubs the “Debt Exposed” — are utilities, real estate and telecommunications, because they “currently garner the highest leverage and lowest EBITDA coverage which could pose downside to EPS if rates remain higher for longer.”

Source: Evercore ISI

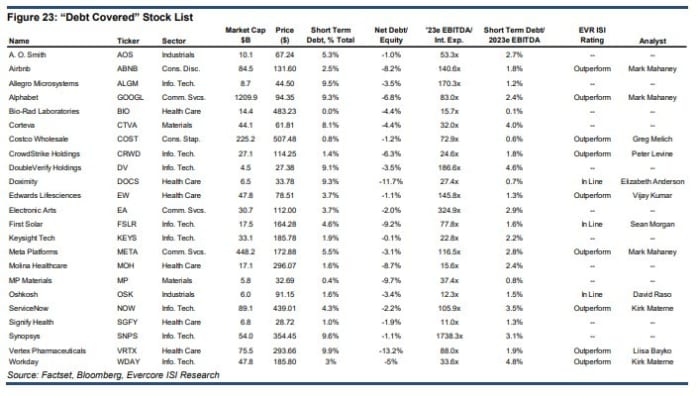

The sectors relatively more immune for higher interest rates — the “Debt Covered” — are information technology, energy and healthcare.

Source: Evercore ISI

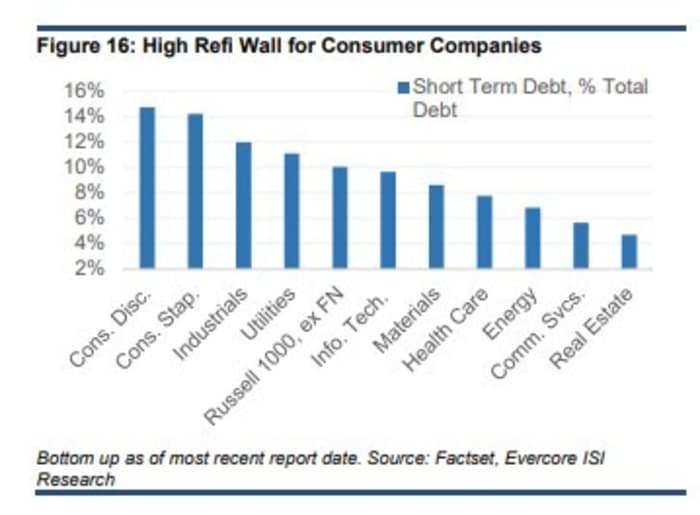

Evercore also notes that consumer discretionary and consumer staple companies face problems from higher interest rates because they have a large proportion of short-term debt that will soon need refinancing.

Source: Evercore ISI

However, those sectors will be supported by the spending of households sporting relatively healthy balance sheets.

“[H]ouseholds have remained relatively sheltered from rising interest rates. Deleveraging since the GFC [global financial crisis] is expected to have lowered households’ interest rate sensitivities. Balance sheets have improved across nearly all income quintiles,” said Evercore.

[ad_2]

Source link