The stock market hit a pandemic bottom 3 years ago. Here’s how it has performed since then.

[ad_1]

It has been three years since the U.S. stock market hit its COVID-19 bottom as the global economy suddenly shut down at the start of the pandemic in early 2020.

The S&P 500

SPX,

has risen nearly 76% from its closing low of 2237.40 reached on March 23, 2020, while the Dow Jones Industrial Average

DJIA,

is up 72.3% from its low of 18591.93 hit on the same day and the Nasdaq Composite

COMP,

has advanced over 70%, according to Dow Jones Market Data.

Infections caused by COVID-19 began to spread in early 2020, and panic triggered by the economic uncertainty led to a drop in the stock market that started in late February. On Feb. 24, the Dow industrial average slumped more than 1,000 points, its third-worst daily point drop in history.

The selloff accelerated in mid-March, with the Dow entering bear-market territory on March 10, down more than 20% from the record close set in the previous month. Meanwhile, the large-cap index S&P 500 dropped nearly 34% in about a month, wiping out three years’ worth of gains for the market, according to Dow Jones Market Data.

However, a massive amount of support from the Federal Reserve, including an emergency interest-rate cut, as well as the quick development of COVID-19 vaccines, limited a further downturn in stocks. The S&P 500 rose to an all-time high in August and reached several more all-time highs in the following months, according to Dow Jones Market Data.

In 2021, three major indexes all closed out the year with robust gains as investors brushed off a series of market-moving events that could have crashed stocks. The strong performance came in a year defined by, among other things, the January 6 attack on the U.S. Capitol, supply-chain disruptions, high inflation, labor-market shortages and the omicron and delta COVID variants.

But as the calendar flipped to 2022, U.S. stocks started to tumble after the Federal Reserve and central banks around the globe began raising interest rates aggressively to fight surging inflation, stoking fears of a global recession.

Russia’s invasion of Ukraine in February 2022 and China’s zero-COVID policies, in place until the country suddenly scrapped the stringent measures in December 2022, also contributed to market volatility. The three stock indexes all suffered their worst year since 2008.

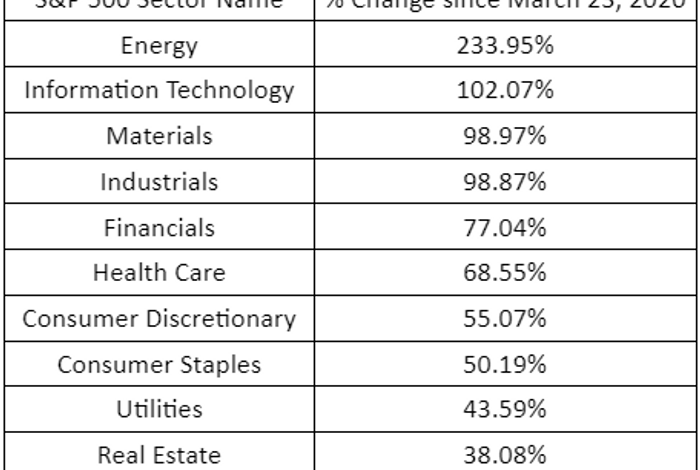

Among 11 S&P 500 sectors, energy

SP500.10,

has been the best-performing sector over the past three years. The sector was boosted by a spike in crude-oil and natural-gas prices in the aftermath of Russia’s invasion of Ukraine.

DOW JONES MARKET DATA

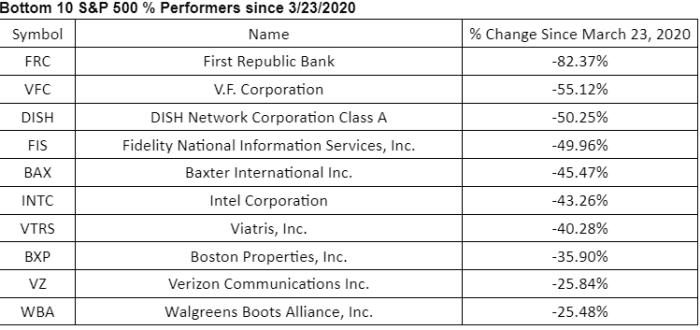

Among individual stocks, First Republic Bank has been the worst performer in the S&P 500 since March 2020, with the financial institution coming under stress following the collapse of two U.S. regional banks.

DOW JONES MARKET DATA

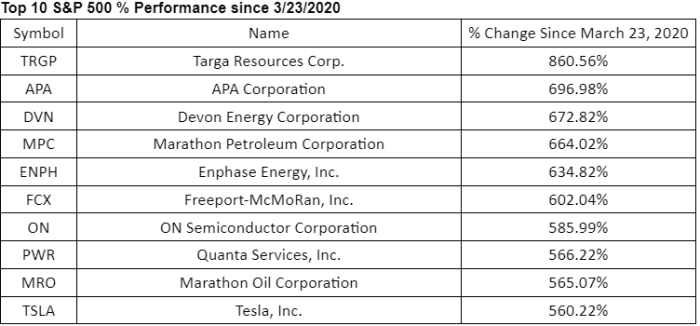

DOW JONES MARKET DATA

Also see: The Fed pivot is near, and yield curve inversion has likely peaked. That’s usually bad news for stocks, this Fidelity strategist says.

U.S. stocks rallied on Thursday after closing sharply lower in the previous session. The Federal Reserve raised interest rates by another 25 basis points on Wednesday while noting that policy makers weren’t penciling in rate cuts this year, despite recent stress in the banking industry. Stocks also reacted after Treasury Secretary Janet Yellen said she wasn’t considering steps to guarantee all bank deposits.

The S&P 500 gained 0.3%, while the Dow advanced 0.2% and the Nasdaq Composite was up 1%.

[ad_2]

Source link