The stock market’s pullback is healthy

[ad_1]

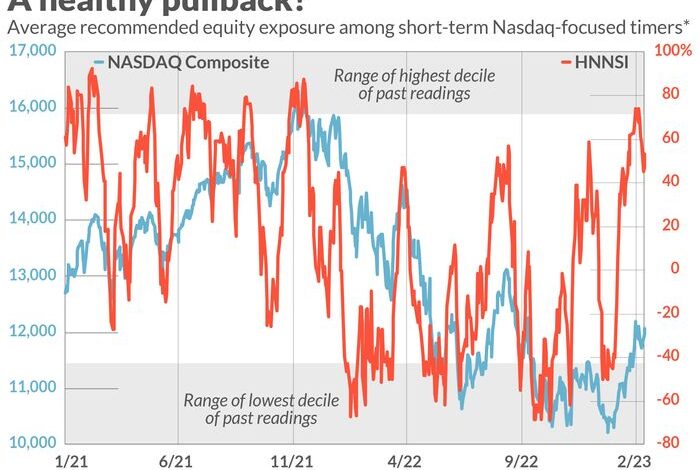

The stock market’s recent pullback may have bought the market’s recent rally more time.

That’s because short-term market timers since the beginning of February have on average significantly retreated from their prior bullishness. As I indicated two weeks ago when anticipating a market pullback, “it would be a positive sign if the timers on balance quickly jump off the bullish bandwagon at the first sign of market weakness.” In that event, the pullback would likely be relatively modest and the market’s rally could resume fairly quickly.

The first part of this script has certainly come to pass. Since the market’s early February high, the S&P 500

SPX,

has slipped just 2.1%, and the Nasdaq Composite

COMP,

just 2.8%. But these small declines have still been enough to cause the average short-term market timer to become markedly less optimistic.

Consider first the average recommended equity exposure level among a subset of short-term market timers who focus on the Nasdaq stock market in particular. (This average is what’s tracked by the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI.) At the time of my two-weeks-ago column on market sentiment, the HNNSI stood at the 90.1 percentile of its historical distribution since 2000. It today stands at the 69.2 percentile.

Even more subdued are those market timers who focus on the broad market rather than the Nasdaq market in particular. The average of their current exposure levels stands at the 50.8 percentile of its two-decade distribution.

It’s remarkable that the market timers aren’t more upbeat. At its peak earlier this month, the Nasdaq Composite was up more than 20% from its late-2022 low, thereby satisfying the semiofficial criterion for what constitutes a new bull market. It’s only modestly below that threshold level now. Yet the market timing community is in a meh mood, and that’s bullish — relative to what we’d normally expect in the wake of a rally as strong as the one recently.

Note carefully that contrarian analysis is at best a short-term tool, providing insight over an horizon that doesn’t extend out much more than a month or two. So market timers’ recent behavior sheds no light on where the stock market may be by the end of this year.

At a minimum, though, contrarians believe the outlook for the next several weeks is a lot more upbeat than it would have been had the market timers behaved as they normally would after a greater-than-20% rally and become excessively bullish.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.

[ad_2]

Source link