These ignored stocks have the edge over Wall Street: Schwab strategist

[ad_1]

The month of March is winding down in a not-too-shabby fashion as the banking mess seems calmer for now. After an ugly February, the S&P 500

SPX

is set for a 1.4% gain, while the Nasdaq Composite poised to bounce 4%.

Cast the net wider, says our call of the day from Charles Schwab’s chief global investment strategist Jeff Kleintop, who thinks international stocks are an overlooked opportunity right now.

“This is an area that investors have been shying away from for over a decade, yet every month this year, international stocks have outperformed U.S. stocks through the fears of recession in January, to the overheating and inflation worries of February to the financial crisis of March,” Kleintop told MarketWatch in an interview on Wednesday.

To be sure, the year is young. Schwab’s International Equity exchange-traded fund (ETF)

SCHF,

which has a four-star rating on Morningstar, is up 6.4% so far this year, from a 17% fall in 2022 — the SPDR S&P 500 ETF Trust

SPY,

a reflection of the main index, is up nearly 5% after a 19% tumble last year.

“We’ve consistently seen international stocks outperform and they’re up 6% this quarter so far, and that’s a pretty darned good return, and they outperformed lats year as well for the first time in about a decade,” said Kleintop.

He notes the Stoxx Europe 600 index

XX:SXXP

is expected to see 6% earnings growth in the first quarter, versus negative 5% for the S&P. “The banking stress is not as acute in Europe and valuations are much lower. So I think this is an area where investors can find attractive opportunities in an environment of higher volatility,” he said.

Read: International stocks outperform, decouple from U.S. equities by ‘unusual degree’

“Pretty much every country in Europe is seeing positive economic surprises over the past month so their data has been coming in better than expected. Again, earnings look pretty good, valuations are lower,” said Kleintop. International companies are also offering lots of what investors should be seeking out now — near-term cash flow, he said.

As for Wall Street, the strategist is wary about more volatility to come this year. Like others, he’s worried about the U.S. commercial real-estate sector, which could be complicated especially given lending seen by smaller banks.

“One, they don’t have a lot of revenue because their vacancies are very high and two, now borrowing money to carry the cost of that real estate is quite high…That’s not true outside the U.S. where there’s relatively little commercial real-estate exposure for the banks and vacancy rates are much, much lower,” he said.

Elsewhere, Kleintop said U.S. smaller companies, which often perform well coming out of a downturn and concerns about recession, may struggle, given their dependency on borrowing and lack of strong cash flow profiles versus energy, materials and industrials.

Last word from Kleintop zeroes in on what he sees as a potential blind spot for investors.

“I think my number one concern is that inflation comes in waves, like COVID did…I don’t think markets are prepared for inflation to tick back up again for a month or two, before it hits lower. Markets are expecting the Fed’s going to be able to cut rates later this year, and I don’t know if that’s going to remain the case if we start to see some uptick in inflation.”

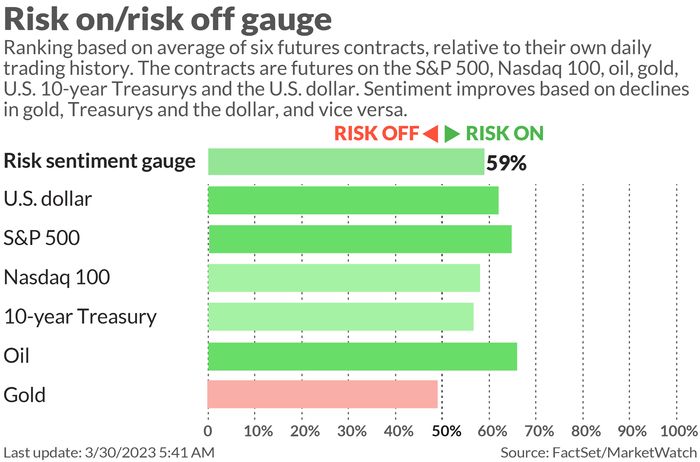

The markets

Stocks

DJIA

COMP

are headed towards three-week highs, with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

are rising and the dollar

DXY

is dropping. Oil

CL00

is up 1%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Fourth-quarter GDP was revised down to annual growth of 2.6% from 2.7%, while weekly jobless claims rose 7,000 to 198,000, the highest level in three weeks. Still to come, Boston Fed President Collins and Richmond Fed President Barkin are speaking at 12:45 p.m., with Minneapolis Fed President Kashkari at 1 p.m.A Wall Street Journal reporter has been arrested in Russia on spy charges.

RH stock

RH

is down 6% after the holding company, which home goods retailer Restoration Hardware, posted a profit and sales fall in the latest quarter.

Roku stock

ROKU

is up over 2% after the streaming-media group says it cut axe 200 jobs and reduce use of some office spaces. Electronic Arts

EA

is laying 6% of its employees as the videogame publisher joins the tech industry’s cost-cutting pushes. Those shares are up slightly.

More job-cutting news from Warner Music

WMG,

which plans to reduce its workforce by 4%, or 270 jobs.

EVgo stock

EVGO

rose 3.5%, after the electric-vehicle charging infrastructure company reported a near 4-fold forecast-beating climb in revenue, as losses narrowed sharply.

The average Wall Street bonus tumbled 26% last year to $176,700, New York City’s securities comptroller reported.

Best of the web

The chart

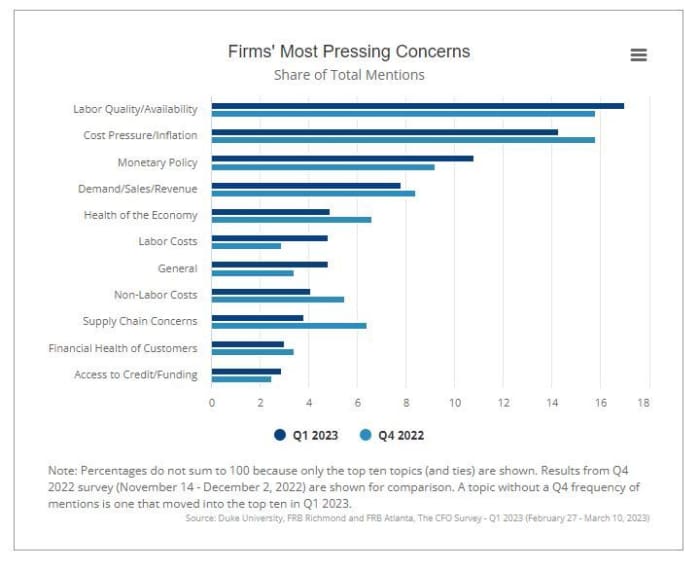

Access to credit or funding is the least of worries cited by chief financial officers across U.S. companies, according to the latest quarterly CFO Survey from Duke and the Federal Reserve Banks of Richmond and Atlanta. Their biggest concern is finding quality workers, followed closely by inflation, as the below chart shows:

The tickers

These were the top searched tickers on MarketWatch as of 6 a.m.

Random reads

The cost of relocating Pablo Escobar’s hippos? $3.5 million.

Once and for all, start eating like the Mediterraneans.

Why digital cameras may stand the test of time.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link