What market historians expect from stocks and bonds over the next two decades

[ad_1]

Well, the worst day of the year for the stock market was followed by, basically nothing. Neither day had much in the way of new fundamental information, and on Thursday stock futures are higher. Animal spirits are as important as hard logic sometimes.

Thursday also saw the release of the Credit Suisse Global Investment Returns yearbook, produced by financial historians Elroy Dimson, Paul Marsh and Mike Staunton. It has the record of returns from equities, bonds, cash and currencies for 35 countries, stretching back to 1900. There is also data covering a total of 90 countries, including the most recent addition, Bosnia and Herzegovina, with data going back to 2011.

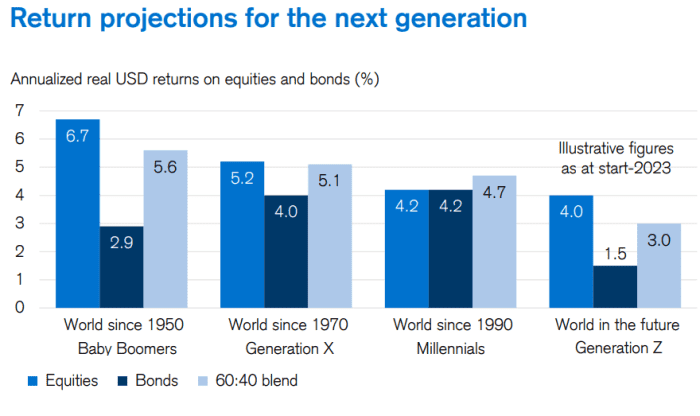

First, to the numbers: Over the last 123 years, global equities have returned an annualized return, adjusted for inflation, of 5%; that’s better than the 1.7% real return for bonds, and the 0.4% return for Treasury bills. The best country for inflation-adjusted annualized stock-market returns in U.S. dollar terms since 1900 has been Australia, with a return of 6.43%, though the U.S. is just behind at 6.38%. Equities have outperformed bonds, bills and inflation in all 35 countries where the researchers have data for 123 years.

Dimson/Marsh/Staunton

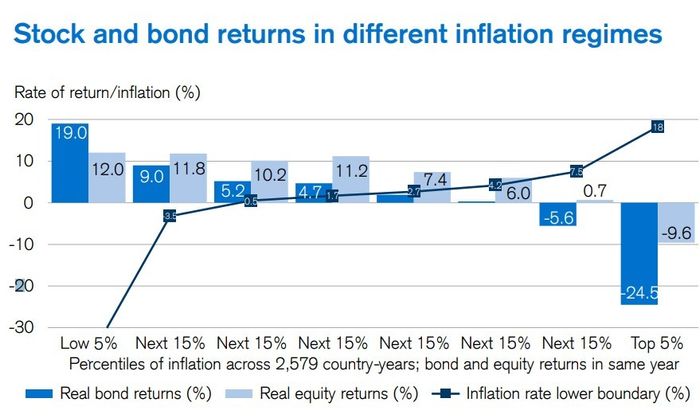

On the day’s subject du jour, they said that once inflation goes above 8%, it takes multiple years to return to target, citing recent research. Equities do not provide a hedge against inflation, as they found and as 2022 returns showed. And historically, the returns on stocks and bonds have been much lower during hiking cycles than easing cycles.

The researchers also studied commodities: commodities have had a low correlation with equities and a negative correlation with bonds, and provided a hedge against inflation, but they note the investable market size is quite small, making large allocation increases difficult.

Dimson/Marsh/Staunton

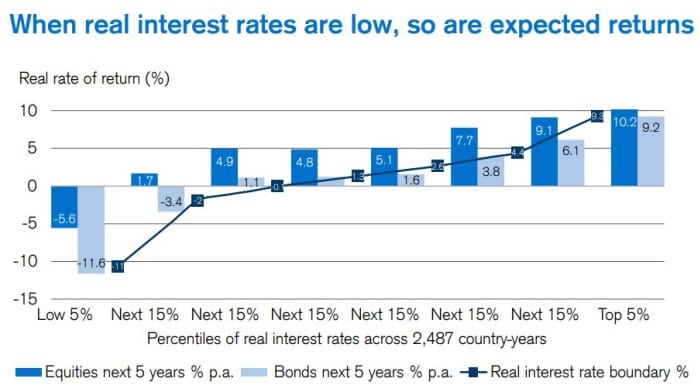

Onto the future — they estimate the equity risk premium to bills will be around 3.5%, which is lower than the historical figure of 4.6%. But that still means equity investors should double their money relative to short-term government bills in 20 years. They note that in thinking about future returns, real returns tend to be better in times of higher interest rates than lower rates, citing data over an impressive 2,487 country-years .

Dimson/Marsh/Staunton

They project that for Generation Z will see roughly the same return in stocks as millennials have, but much worse bond returns. Baby boomers, Marsh told a journalist on a call, “just got lucky. I don’t think we will ever return to that.”

The market

U.S. stock futures

ES00

NQ00

were pointing to a stronger start. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

edged up to 3.95%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Nvidia

NVDA

shares surged in premarket action as the graphics chipmaker forecast first-quarter revenue above Wall Street expectations and laid out how it aims to profit from opportunities in artificial intelligence.

Unity Software

U

shares slumped after the game-engine company forecast revenue below estimates.

Alibaba stock

BABA

rose 4% as fiscal third-quarter earnings at the Chinese internet giant beat fourth-quarter earnings expectations.

Etsy

ETSY

shares surged on better-than-forecast revenue from the arts e-commerce site, though current quarter sales are projected to be in line with estimates. EBay

EBAY

shares. however, slipped as it reported a decline in volume. Electric vehicle maker Lucid

LCID

dropped after a delivery forecast well below estimates.

The economic calendar includes weekly jobless claims and the first revision to fourth-quarter GDP numbers, while Atlanta Fed President Raphael Bostic and San Francisco Fed President Mary Daly are set to deliver remarks. Treasury Secretary Janet Yellen, in India for the G-20 finance minister meeting, said the global economy is in a better place than it was just a few months ago.

Best of the web

Employee doubts are rising about Taiwan Semiconductor Manufacturing Co.’ s

TSM

expansion into Arizona.

Even Russia’s foreign minister was surprised by the decision to invade Ukraine, and most of the cabinet was kept in the dark, according to anonymous accounts from Russian officials.

Deutsche Bank

DB

officials attended meetings inside Jeffrey Epstein’s home when victims were present, lawyers for survivors allege. Deutsche Bank says the lawsuit should be thrown out.

Top tickers

Here were the most active stock market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| NVDA | Nvidia |

| AMC | AMC Entertainment |

| BBBY | Bed Bath & Beyond |

| GME | GameStop |

| AAPL | Apple |

| BABA | Alibaba |

| NIO | Nio |

| APE | AMC Entertainment preferreds |

| AMZN | Amazon.com |

Random reads

These images produced by the James Webb Space Telescope are so unusual they’re being dubbed universe breakers, because the galaxies were so massive at an early stage of the universe.

“Veg-xit” — Brits deal with a shortage of fruits and vegetables.

This 11-year-old girl is entering “semi retirement” after making so much money from selling fidget spinners and bows that she bought a Mercedes-Benz GI.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link