Why one strategist sees a real risk of World War 3.1, whose battleground will be microchips

[ad_1]

Welcome back from a three-day break honoring America’s founding father, which one congresswoman decided to celebrate by proposing a national divorce. Would a blue and red state split be good for stocks? Bad probably for defense contractors but there would be whole new asset classes opening up, so who knows. Investors tend to reward spinoffs, after all.

What is real are the increasing tensions between the U.S. and China, and in particular the technology sector. At the center of these tensions is ironically enough, a Dutch company. Microchip equipment maker ASML

ASML

has been restricted by the U.S. from selling the most up-to-date equipment to China, and now has disclosed theft of intellectual property by China.

Peter Tchir, head of macro strategy at Academy Securities, dubs a potential war over semiconductors World War 3.1. He cites a retired lieutenant general, Robert Walsh, in noting why chips are so important. For one, the U.S. wants to prevent China from getting the highest-end chips that can be used in advanced military systems during a conflict with the U.S.

Walsh also notes the U.S. operational concept for future warfare is the Joint All-Domain Command & Control Strategy, while China’s concept is the Multi-Domain Precision Warfare — both needing high-end semiconductors. Walsh adds that China aims to be the global artificial intelligence leader by 2030 and on par with the U.S. military by 2035, and that high-end chips are needed for AI, supercomputing and weaponizing technology.

Tchir divides the current semiconductor space into four — cutting edge, which is dominated by Taiwan; high tech, which is one to three generations behind and where Taiwan is a leader but the U.S. is competitive; mid-to-low tech, which is global in nature; and commodity chips. And he says there’s a real risk that the U.S. pushes too hard, that Washington blocks technology that is not as critical, crippling sales by U.S. companies to China. “From a commerce standpoint, there is a balancing act that needs to be executed by D.C. So far, so good, but it is something that needs to be watched closely,” says Tchir.

According to FactSet, 29% of the revenue from companies in the iShares Semiconductor ETF

SOXX

come from China.

The other major risk from a semiconductor perspective is that China invades Taiwan, or, from its perspective, reunites a renegade province by force. That would run the risk that the factories would be damaged to the point they are inoperable, though the flip side is that in that scenario, the West would not be able to get those chips either.

What would be the investment implications of World War 3.1 breaking out? Tchir says in that scenario, he would reduce China exposure. The iShares China Large-Cap ETF

FXI

and the KraneShares CSI China Internet ETF

KWEB

have been faltering of late because the reopening isn’t going great, but more pressure from U.S. would also hurt. He also says that there’s a chance China decides to supply arms to Russia — a point U.S. officials have been making loudly of late — which would further strain the U.S.-China relationship, already damaged by the balloon that flew over the U.S. Tchir said he would also watch the U.S. semiconductor space closely if there were increased sanctions.

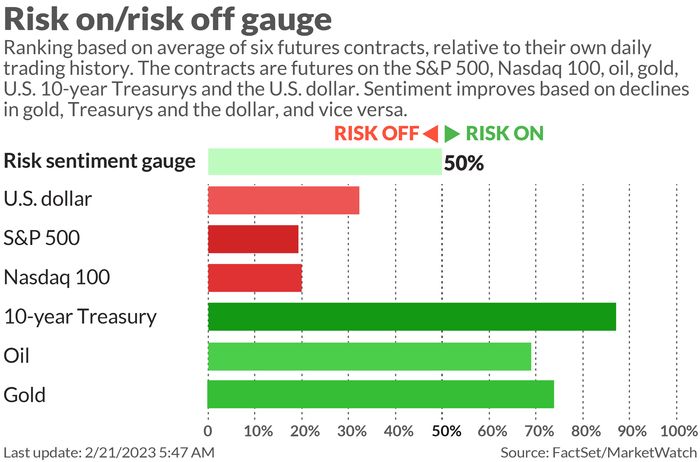

The market

U.S. stock futures

ES00

NQ00

were weaker as rate fears, as well as geopolitical tensions, weighed on sentiment. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was 3.87%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Retailers Walmart

WMT

and The Home Depot

HD

headline Tuesday’s earnings slate. Home Depot said it expects flat sales this year.

Credit Suisse

CS

shares slumped after Reuters reported a regulatory probe into comments made by the bank’s chairman that outflows had stopped in December, when the bank later said they had continued. HSBC

HSBC

shares slipped amid 2023 guidance that analysts viewed as cautious.

The U.S. economics calendar features flash purchasing managers indexes and existing home sales data, ahead of Wednesday’s release of Fed minutes.

President Joe Biden made a surprise visit to Ukraine, and then traveled to Eastern Europe. Russian President Vladimir Putin was delivering his state-of-the-nation address after a year of war in Ukraine, and pinned the conflict’s blame on the West.

Best of the web

Lithium stocks crashed — now we know why.

Ray Dalio gets billions more to retire.

The man blamed for $577 million of alleged phony nickel shipments.

Top tickers

Here the most active stock market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| BBBY | Bed Bath & Beyond |

| AMC | AMC Entertainment |

| GME | GameStop |

| AAPL | Apple |

| TRKA | Troika Media |

| NIO | Nio |

| MULN | Mullen Automotive |

| AMZN | Amazon.com |

| APE | AMC Entertainment preferreds |

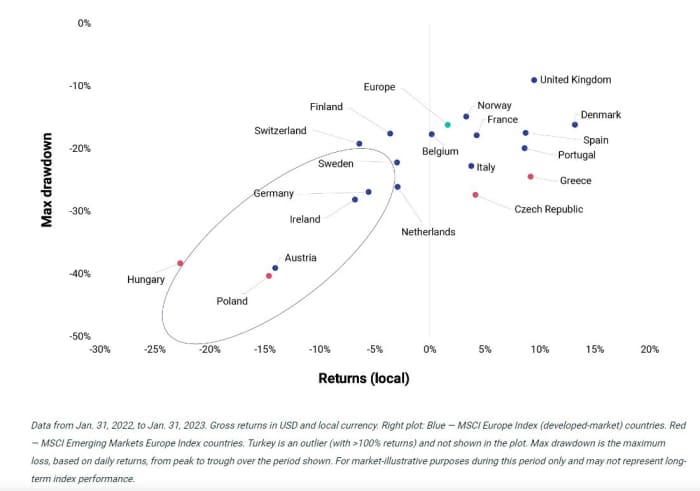

The chart

MSCI

A year on from Russia’s invasion of Ukraine, it’s turns out European equities have handled the war in their own backyard rather well, as this chart from MSCI shows. Hungary, Poland and Germany are exceptions, owing to their reliance on Russian energy.

Random reads

A fond if not-safe-for-work reminiscence of the 1990s.

In the Bahamas, a dog took on a hammerhead shark, and emerged victorious.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link