S&P 500’s softening earnings backdrop is a challenge for stocks in ‘very near term,’ says RBC

[ad_1]

The S&P 500 earnings backdrop is softening, posing a challenge for stocks in the “very near term” even as companies so far are largely beating expectations for the fourth quarter, according to RBC Capital Markets.

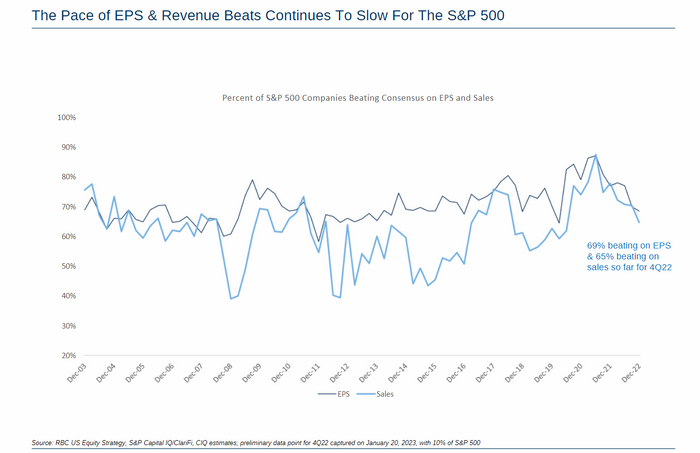

“With 10% of S&P 500 results in as of Friday,” the pace of companies exceeding consensus forecasts for earnings has slowed, said Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, in a research note Monday. Sixty-nine percent of companies are beating expectations for earnings per share, or EPS, for fourth-quarter results, while 65% are surpassing consensus revenue forecasts, the report shows.

“While beats are still the norm, both stats are tracking a little lower than” reporting season for third-quarter results, said Calvasina, pointing to a chart highlighting the percent of companies beating consensus on EPS and sales.

RBC CAPITAL MARKETS NOTE DATED JAN. 23, 2023

“Overall, we continue to see signs that the earnings backdrop for the S&P 500 is softening, though it’s fair to say that expectations are not sliding yet,” she said.

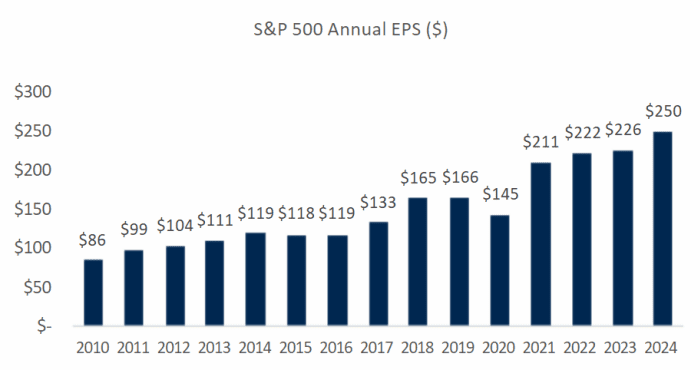

Forecasts for the S&P 500’s earnings per share in 2023 now stand at $226, implying a year-over-year growth rate of 2%, Calvasina said. She wrote that consensus S&P 500 EPS growth is “still creeping down” for the fourth quarter and this year while rising for 2024.

RBC CAPITAL MARKETS NOTE DATED JAN. 23, 2023

In terms of consensus EPS forecasts for 2023, “the deterioration in expectations has been broad based over the last few months, having been driven by all sectors with the exceptions of” real-estate investment trusts, utilities, consumer staples, and industrials, according to the RBC note.

Meanwhile, the Conference Board said Monday that its leading economic index for the U.S. dropped 1% in December. That was more than the 0.7% decline expected by the economists polled by The Wall Street Journal.

See: This major economic indicator keeps forecasting recession

The U.S. stock market was trading sharply higher Monday afternoon, with the S&P 500

SPX,

up 1.5% at almost 4,031 while the Dow Jones Industrial Average

DJIA,

rose 1% and the Nasdaq Composite gained 2.1%, according to FactSet data, at last check. The S&P 500 has broken above its 200-day moving average of about 3,966, the data show.

“The first full week of the fourth quarter earnings season has ended and the results have been underwhelming—as we expected—rather than alarming,” said Mark Haefele, chief investment officer at UBS Global Wealth Management, in a note Monday.

“A slowing US economy looks likely to maintain pressure on companies,” he said. “We don’t see much scope for markets to rally in the near term, especially given our outlook for continued pressure on corporate profit growth.”

[ad_2]

Source link