Investors beware. It’s the market relationship with data that may pivot when the Fed pauses, says Citi.

[ad_1]

Stocks on Friday looked ready to retreat a smidgeon as Wall Street closes out the week.

That’s OK, the S&P 500

SPX

is already up 5.75% in 2023, helped by the belief that slowing economy and softening inflation will allow the Federal Reserve to be less aggressive in raising borrowing costs.

This has meant that somewhat poor economic data is generally well received by equity investors. (Catastrophically bad economic news may be a different matter!).

That correlation may be put to the test again next week when the Fed is expected to deliver a 25 basis point rate hike, followed by a press conference with Chairman Jay Powell.

But stock bulls who hope to find signals the central bank will soon stop tightening policy may wish to think again. That’s the warning from Citi’s quantitative global macro strategist Alex Saunders, who says investors must brace for a shift in market responses.

“U.S. equity market reaction to economic surprises right now is that bad news is good for markets. This is one of the best regimes for U.S. equities. This correlation between news flow and equity markets is typical during hiking cycles,” he says.

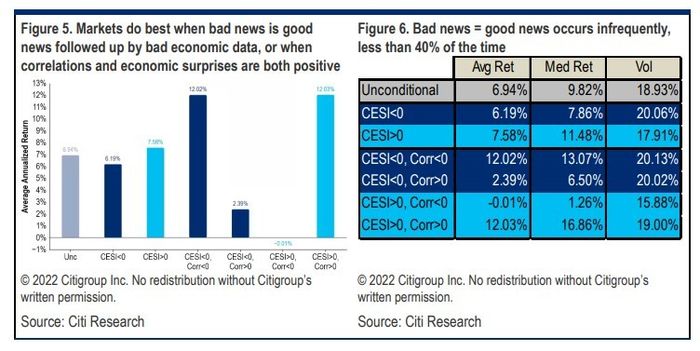

Saunders studied Citi’s economic surprise index and its relationship to stock market action, and overlaid that with the monetary policy cycle.

The chart below shows the mean returns in four regimes. The best regime, says Saunders, is with positive economic surprises, and a positive equity/surprise correlation, which happens 34% of the time.

Source: Citi.

The worst outcome is when the market gets good economic news and equity/bond correlations are negative, which happens 18% of the time.

However: “The current reading on Citi’s economic surprises index is -15 and the correlation between surprises and returns is negative – markets have tended to react positively to a weaker surprise index.”

The likely reason is equities seek relief from the end of hiking cycles.

But this relation tends to flip once the Fed goes on hold, “As the hiking cycle matures, the correlation between economic surprises and U.S. equity market performance could turn positive. In this case, weak economic data from a likely 2H U.S. recession would weigh on markets”.

Source: Citi.

Such a transition to a regime where bad news is bad news “could be the sign that the bear market rally is fading -– for example, the sell-off after weak retail sales numbers earlier this month”.

In fact, Saunders can see the market painting itself into a corner.

“Additionally, a string of positive economic releases would also give us pause in equities, as the Fed could see this as a green light to tighten financial conditions further,” he says.

“The narrow path for equities is either to continue trading bad news in hope of a Fed pivot, or for recession fears to completely recede, inflation to continue falling, and good economic news to become good market news again,” he concludes.

(For more on how telling economic surprises can be see The Chart, below).

Markets

Stock futures

ES00

YM00

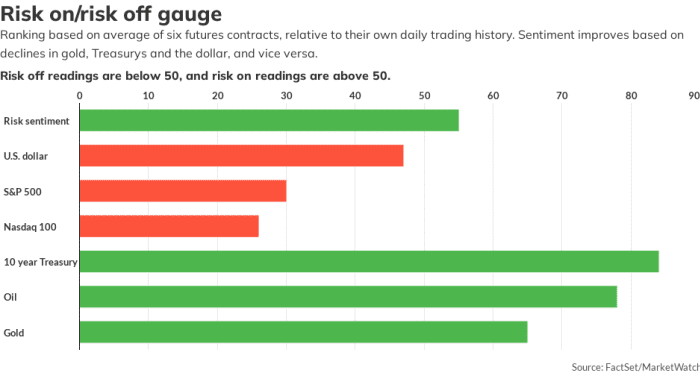

are tilting south, led by Nasdaq-100 futures

NQ00

after poorly-received results from Intel. The 10-year Treasury yield

BX:TMUBMUSD10Y

is up 5 basis points to 3.547%, while the dollar

DXY

is flat, gold

GC00

is softer and crude

CL

is perkier, up 1.2% to $81.98 a barrel.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Intel

INTC

shares are down nearly 10% in premarket action after the chip maker late Thursday reported– a big fourth-quarter miss, and a gloomy forecast.

Watch out at 8:30 a.m. Eastern for the PCE price index report. It’s the Fed’s preferred inflation measure and is likely to have an impact on the central bank’s thinking as it prepares to deliver its monetary policy decision next Wednesday.

Also to come on Friday: real disposable incomes and real consumer spending for December will be released at 8:30 a.m., followed at 10 a.m. by the University of Michigan consumer sentiment index alongside 1-year and 5-year inflation expectations, all for January. December pending home sales are due at 10 a.m. All times Eastern.

The sell-off in shares of companies linked to Gautam Adani, Asia’s richest man, continued on Friday after hedge fund titan Bill Ackman lent his support to Hindenburg Research, the short seller who this week published a critical report into the Adani empire’s activities.

American Express

AXP

stock is up 5% premarket after delivering better-than-expected results and boosting the dividend.

Shares in Hasbro

HAS

are down nearly 4% after the toy maker said it plans to lay off about 15% of its workforce and warned Wall Street of a loss and revenue drop after a disappointing holiday season.

Chevron’s stock

CVX

is down 1% after the oil and gas giant missed fourth-quarter profit expectations, while revenue rose above forecasts.

Best of the web

How Russia’s war on Ukraine changed the global oil trade.

Addressing the “Smoothie Delusion”: big tech slashes office perks.

Meet the latest housing-crisis scapegoat.

The chart

German stocks have been doing well of late. The DAX 40 was up 14.6% over the past three months at Thursday’s close, while the S&P 500 has gained 6.6%.. The chart below from Deutsche Bank partly explains the difference. Sliding energy costs in Europe over the winter, and more recently the opening up of China’s economy, have made German business leaders more optimistic, feeding into economic data.

It is surprises that most move markets. And the Eurozone data has been more positively surprising than those in the U.S.

“The big question for 2023 is whether the momentum in Europe and China and the recent loosening of global financial conditions can help offset some very worrying recent U.S. data. It’s possible that the global economy is normalising from the shock of the Ukraine war and China’s zero COVID policy and that this will help the U.S. in the near term,” said Deutsche strategist Jim Reid.

Source: Deutsche Bank.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

Random reads

Lottery winner blew $50 million in just 8 years.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

[ad_2]

Source link