‘It’s not an earnings release, it’s a crime scene’: Analysts, and social media, react to Intel’s awful quarter.

[ad_1]

“We have written the phrase ‘Worst earnings report in our history of covering this company’ on more than one occasion over the last couple of years. But this time we REALLY mean it…”

That was the comment from a team of analysts at Bernstein, led by Stacy Rasgon, and a sampling of shock waves rippling across the investment landscape after the chip maker delivered its worst results in 20 years and a grim forecast.

Intel

INTC,

shares were poised to open nearly 10% lower at $27.20. A year ago, they traded around $50.

Rasgon, who cut his price target to $20 per share from $23 and held to an underperform rating, zeroed in on the company’s first-quarter outlook, calling it “astonishingly bad even vs. low expectations, with revenues and gross margins collapsing.”

Opinion: Intel just had its worst year since the dot-com bust, and it won’t get better soon

Intel forecast an adjusted loss of 15 cents a share for the current quarter versus expectations it would earn 25 cents, and said revenue would sink further to $10.5 billion, versus an expected $13.93 billion, as the company warned of a contracting data-center market and a glut of inventory.

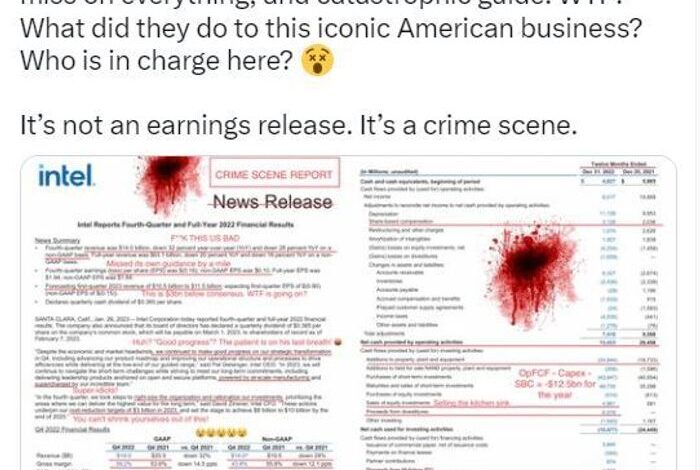

“It’s not an earnings release. It’s a crime scene,” commented Twitter user Wasteland Capital, who added some colorful reactions to the company’s results released late Thursday:

@ecommerceshares

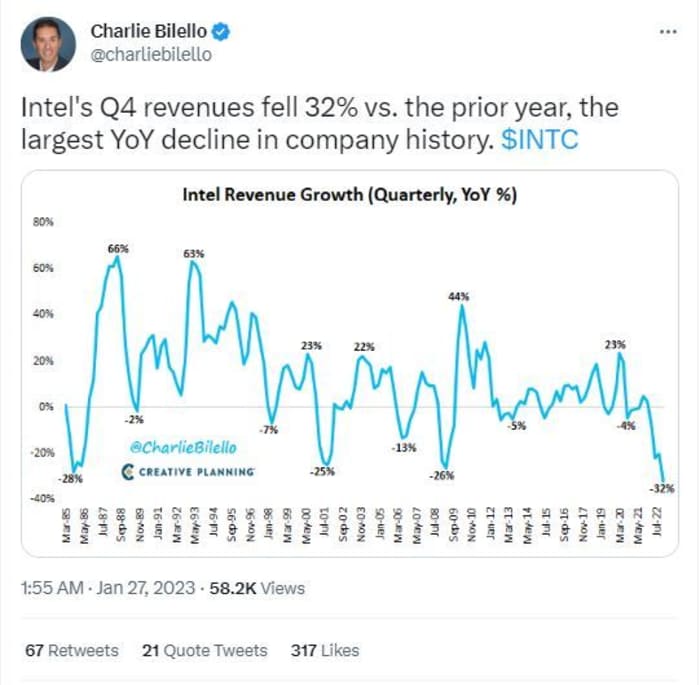

Charlie Bilello, chief market strategist at CPI Wealth, used a chart to visualize just how bad the company’s 32% slump in fourth-quarter revenue looked on a historical basis:

@charliebilello

JPMorgan analysts led by Harlan Sur, dropped their price target to $28 per share, from a prior $32, as they predicted weakness would broaden to Intel’s other end market segments beyond PC and datacenter/enterprise demand. The bank rates Intel “underweight.”

“Overall given the increased competitive pressures the company is facing in client/server compute combined with a less than stellar track record on technology/product execution, we believe it will be a challenging road ahead for Intel as it navigates a tough macro environment and strives to close the performance gap with rival AMD

AMD,

” wrote Sur and a team in a note to clients.

Warning investors to steer clear of the stock, Stephanie Link, chief investment strategist and portfolio manager at Hightower Advisors, said on Twitter that Intel was “one of ‘the’ value traps out there.” She highlighted the 1,200 basis point decline in annual margins and another 480 basis point decline expected the next quarter. “This is more than the industry’s cyclical downturn,” said Harlan.

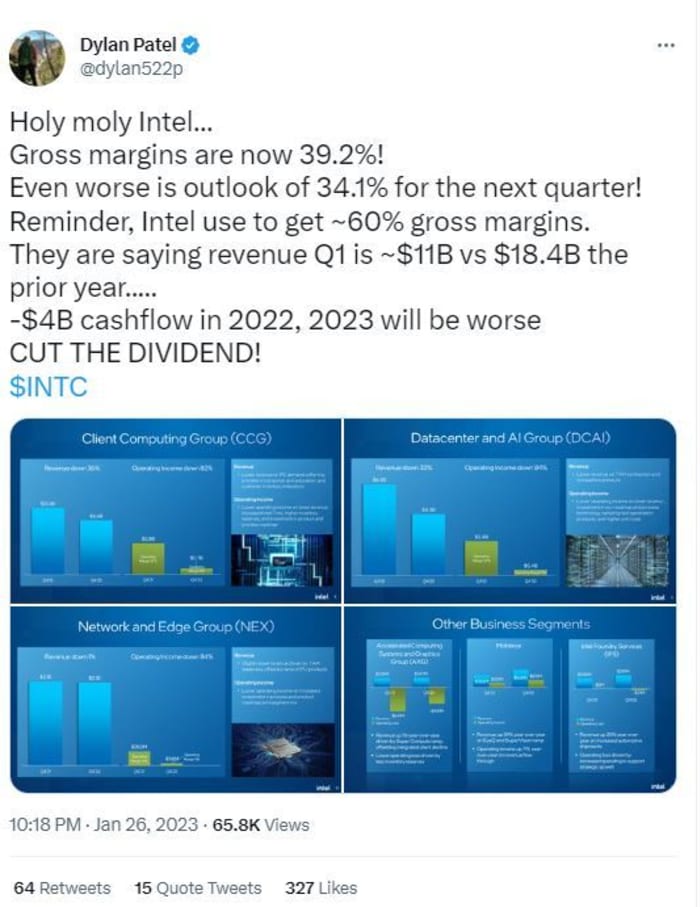

Some pointed to Intel’s dividend, saying it was time for the company to perhaps trim that back. It paid a $0.36 cash dividend for each quarter of last year, and has faithfully paid a dividend for each quarter since 2013, and paid $1.5 billion in dividends during the fourth quarter.

@dylan522p

Here’s a closer look at Intel’s dividend math.

Cowen analysts were almost left speechless, entitling their research: “Couldn’t really think of a title to describe that, but here’s the note anyway.”

“1H23 should be the bottom, but how quickly and to what extent does the business and P&L recover given competitive pressures and necessary investments for the turnaround? A long road ahead,” said a team led by Matthew Ramsay, who cut their price target to $26 per share from a prior $31, keeping a market perform rating.

The bottom?

Bernstein’s Rasgon, for one, wasn’t sure: “We keep asking ourselves when things will be as bad as they can get for Intel. And we keep getting surprised.”

@Mr_Derivatives

[ad_2]

Source link