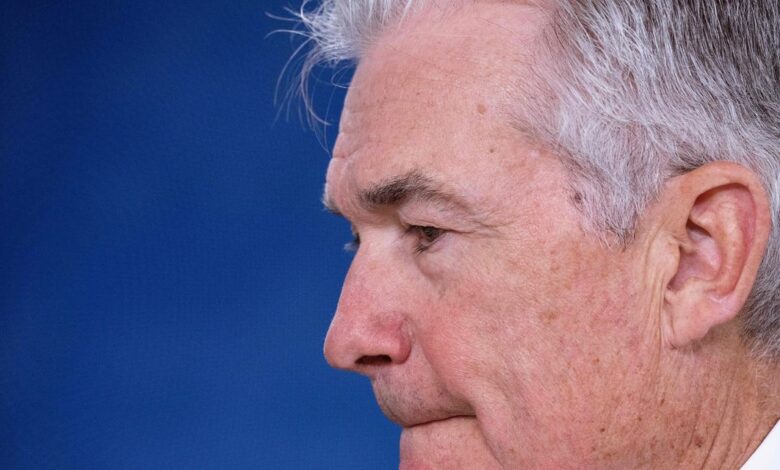

Wall Street to Jerome Powell: We don’t believe you

[ad_1]

Do you want the good news about the Federal Reserve and its chairman, Jerome Powell; the other good news; or the bad news?

Let’s start with the first bit of good news. Powell and his fellow monetary-policy-committee members just lifted short-term interest rates another quarter of a percentage point to 4.75%, which means retirees and other savers are getting the best savings rates in a generation. You can even lock in that 4.75% interest rate for as long as five years through some bank CDs. Maybe even better, you can lock in interest rates of inflation (whatever it works out to be) plus 1.6% a year for three years, and inflation (ditto) plus nearly 1.5% a year for 25 years, through inflation-protected Treasury bonds. (Your correspondent owns some of these long-term TIPS bonds — more on that below.)

The second bit of good news is that, according to Wall Street, Powell has just announced that happy days are here again.

The S&P 500

SPX,

jumped 1% due to the Fed announcement and Powell’s subsequent press conference. The more volatile Russell 2000

RUT,

small-cap index and tech-heavy Nasdaq Composite

COMP,

both jumped 2%. Even bitcoin

BTCUSD,

gained 2%. Traders started penciling in an end to Federal Reserve interest-rate hikes and, then, even cuts. The money markets now give a 60% chance that by the fall Fed rates will be lower than they are now.

It feels like it’s 2019 all over again.

Now the slightly less good news: None of this Wall Street euphoria seemed to reflect what Powell actually said during his press conference.

Powell predicted more pain ahead, warned that he would rather raise interest rates too high for too long than risk cutting them too quickly, and said it was very unlikely interest rates would be lowered this year. He made it very clear that he was going to err on the side of being too hawkish than being too dovish.

Actual quote, in response to a press question: “I continue to think that it is very difficult to manage the risk of doing too little and finding out in 6 or 12 months that we actually were close but didn’t get the job done, inflation springs back, and we have to go back in and now you really do have to worry about expectations getting unanchored and that kind of thing. This is a very difficult risk to manage. Whereas … of course, we have no incentive and no desire to overtighten, but if we feel that we’ve gone too far and inflation is coming down faster than we expect we have tools that would work on that.” (Italics mine.)

If that isn’t an “I would much rather raise too much for too long than risk cutting too early,” it sure sounded like one.

Powell added: “Restoring price stability is essential. … It is our job to restore price stability and achieve 2% inflation for the benefit of the American public … and we are strongly resolved that we will complete this task.”

Meanwhile, Powell said that so far inflation had really only started to come down in the goods sector. It had not even begun to do so in the area of “nonhousing services,” and these made up about half of the entire basket of consumer prices he’s watching. He predicted “ongoing increases” of interest rates even from current levels.

And so long as the economy performs in line with current forecasts for the rest of the year, he said, “It will not be appropriate to cut rates this year, to loosen policy this year.”

Watching the Wall Street reaction to Powell’s comments, I was left scratching my head and thinking of the Marx brothers. With my apologies to Chico: Who you gonna believe, me or your own ears?

Meanwhile, on long-term TIPS: Those of us who buy 20- or 30-year inflation-protected Treasury bonds are currently securing a guaranteed long-term interest rate of 1.4% to 1.5% a year plus inflation, whatever that works out to be. At times in the past you could have locked in a much better long-term return, even from TIPS bonds. But by the standards of the past decade these rates are a gimme. Up until a year ago these rates were actually negative.

Using data from New York University’s Stern school, I ran some numbers. In a nutshell: Based on average Treasury rates and inflation since World War II, current TIPS yields look reasonable if not spectacular. TIPS bonds themselves have only existed since the late 1990s, but regular (non-inflation-adjusted) Treasury bonds of course go back much further. Since 1945 someone owning regular 10-year Treasurys has ended up earning, on average, about inflation plus 1.5% to 1.6% a year.

But Joachim Klement, a trustee of the CFA Institute Research Foundation and a strategist at the investment company Liberum, said the world is changing. Long-term interest rates are falling, in his view. This isn’t a recent thing: According to Bank of England research, it’s been going on for eight centuries.

“Real yields of 1.5% today are very attractive,” he told me. “We know that real yields are in a centuries-long secular decline because markets become more efficient, and real growth is declining due to demographics and other factors. That means that every year real yields drop a little bit more and the average over the next 10 or 30 years is likely to be lower than 1.5%. Looking ahead, TIPS are priced as a bargain right now and they provide secure income, 100% protected against inflation and backed by the full faith and credit of the United States government.”

Meanwhile the bond markets are simultaneously betting that Jerome Powell will win his fight against inflation, while refusing to believe him when he says he will do whatever it takes.

Make of that what you will. Not having to care too much about what the bond market says is yet another reason why I generally prefer inflation-protected Treasury bonds to the regular kind.

[ad_2]

Source link